Ripple’s Senior Vice President, Markus Infanger, stated that the XRP Ledger (XRPL) has the technical capacity to handle large-scale tokenization of real-world assets. He emphasized its speed, scalability, and low transaction fees as key advantages for issuing digital forms of assets such as real estate, commodities, and equities.

According to Infanger, XRPL’s consensus mechanism enables secure and efficient settlement without the need for energy-intensive mining. This makes it more cost-effective for enterprises looking to tokenize assets. He added that the ledger’s built-in features, such as a decentralized exchange and native token support, reduce reliance on external systems, streamlining the token issuance process.

The growing interest in tokenizing traditional financial instruments has prompted Ripple to position XRPL as a core infrastructure layer for this shift. Infanger’s comments align with broader market trends that see blockchain as a bridge between traditional finance and digital asset ecosystems.

Ripple Challenges Proposed U.S. Crypto Regulation

Ripple has openly criticized a newly proposed U.S. cryptocurrency bill, warning that it could give the Securities and Exchange Commission broader control over digital assets. The company argued that such oversight might slow innovation and increase regulatory uncertainty for businesses operating in the blockchain sector.

The bill, according to Ripple, lacks clarity on how different types of digital assets should be classified. Without this clarity, companies may face inconsistent enforcement actions, discouraging investment and development. Ripple urged lawmakers to focus on frameworks that provide clear, predictable rules while protecting investors.

This public stance reflects Ripple’s long-standing call for balanced regulation. The company maintains that constructive engagement between regulators and the industry is essential to building a legal environment that supports both innovation and consumer protection.

Spot XRP ETF Speculation Gains Momentum

Following the resolution of Ripple’s legal battle with the SEC, speculation over a U.S.-listed spot XRP exchange-traded fund (ETF) has increased. The lawsuit’s conclusion removed a significant legal barrier, potentially making it easier for asset managers to seek ETF approval.

Analysts believe a spot XRP ETF could attract a new wave of institutional and retail investors by offering regulated exposure to the asset. This could lead to higher trading volumes and deeper market liquidity. Although no formal ETF applications have been approved, industry watchers are closely monitoring regulatory developments for any signals of change.

Market interest in XRP-related investment products has historically increased during periods of legal clarity. The potential for an ETF approval is now seen as a key milestone in XRP’s broader adoption within traditional financial markets.

AI-Based Forecasting Expands to XRP

Chinese artificial intelligence platform DeepSeek AI has added XRP to its predictive modeling suite, alongside other tokens such as PEPE and Shiba Inu. The platform uses large-scale data analysis to project potential price trends and market scenarios through the end of 2025.

While the forecasts are speculative, they highlight growing use of AI in cryptocurrency analysis. DeepSeek AI’s models consider factors such as trading volume, historical patterns, on-chain activity, and macroeconomic indicators. The aim is to provide traders with probability-based outlooks that can support decision-making.

The inclusion of XRP in these AI-driven forecasts reflects its relevance in the global crypto market. As predictive tools gain sophistication, they may play a larger role in shaping investment strategies, especially for traders who incorporate both technical and fundamental factors into their decisions.

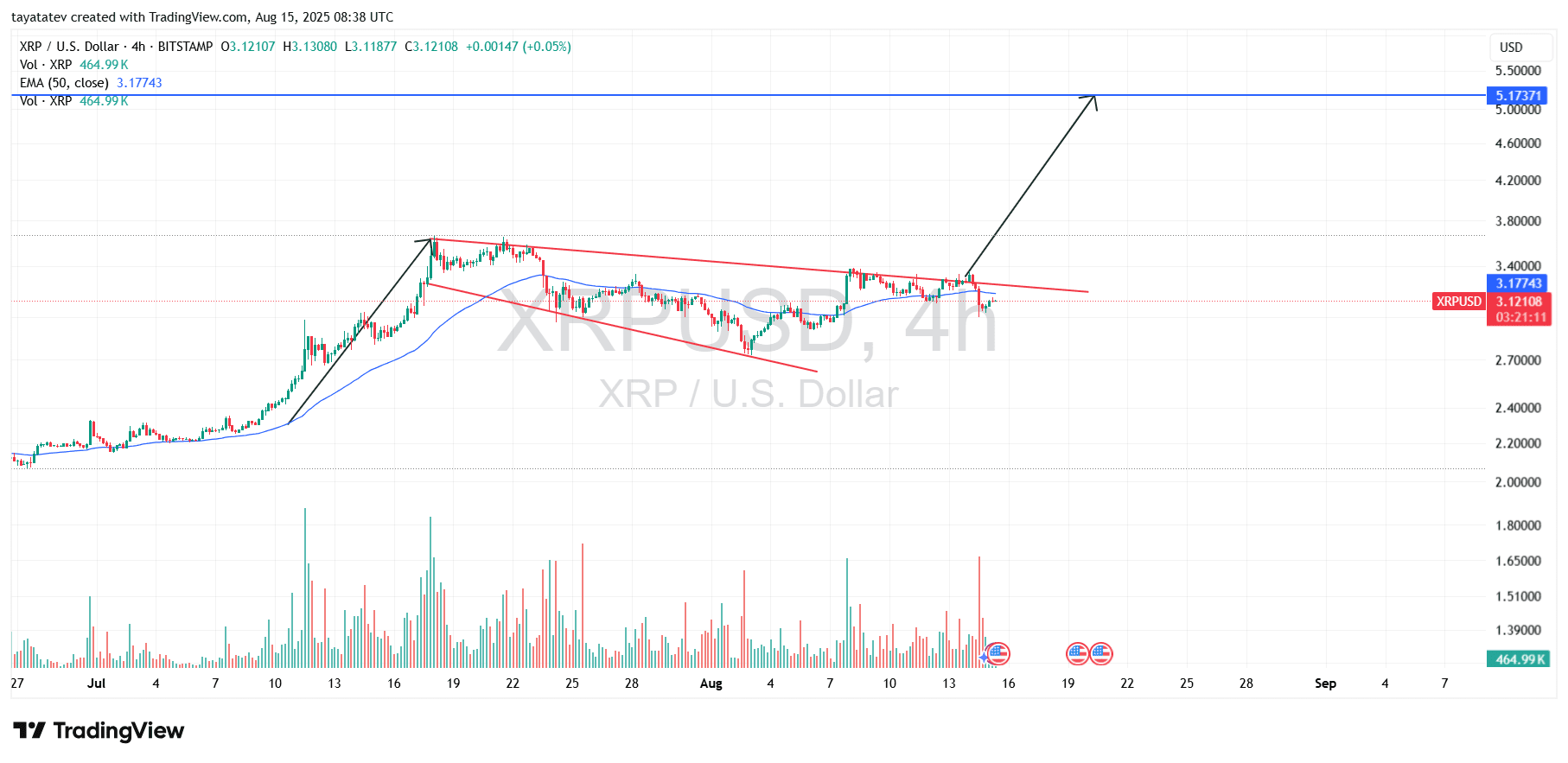

XRP Forms Bullish Expanding Channel, EMA and Volume Support $5.17 Target

August 15, 2025 – XRP has formed a bullish expanding channel pattern on the 4-hour chart, signaling potential continuation of its recent rally. The ascending broadening channel consists of two diverging upward trendlines, showing increasing volatility in the direction of the prevailing trend.

The current price of $3.12 sits just below the 50-period EMA, which is positioned near $3.17 and acting as immediate dynamic resistance. A decisive move above this EMA could strengthen the bullish breakout case.

Trading volume has shown spikes during recent upward moves toward the channel’s upper boundary, indicating growing participation on rallies. Technical projections suggest that a confirmed breakout above resistance could trigger a 65% rise from current levels, setting a target near $5.17. This target is based on the measured move method, applying the channel’s height to the breakout point.

If the pattern confirms, the breakout would put XRP at its highest level since 2021, reinforcing the bullish market structure supported by both price action and technical indicators.

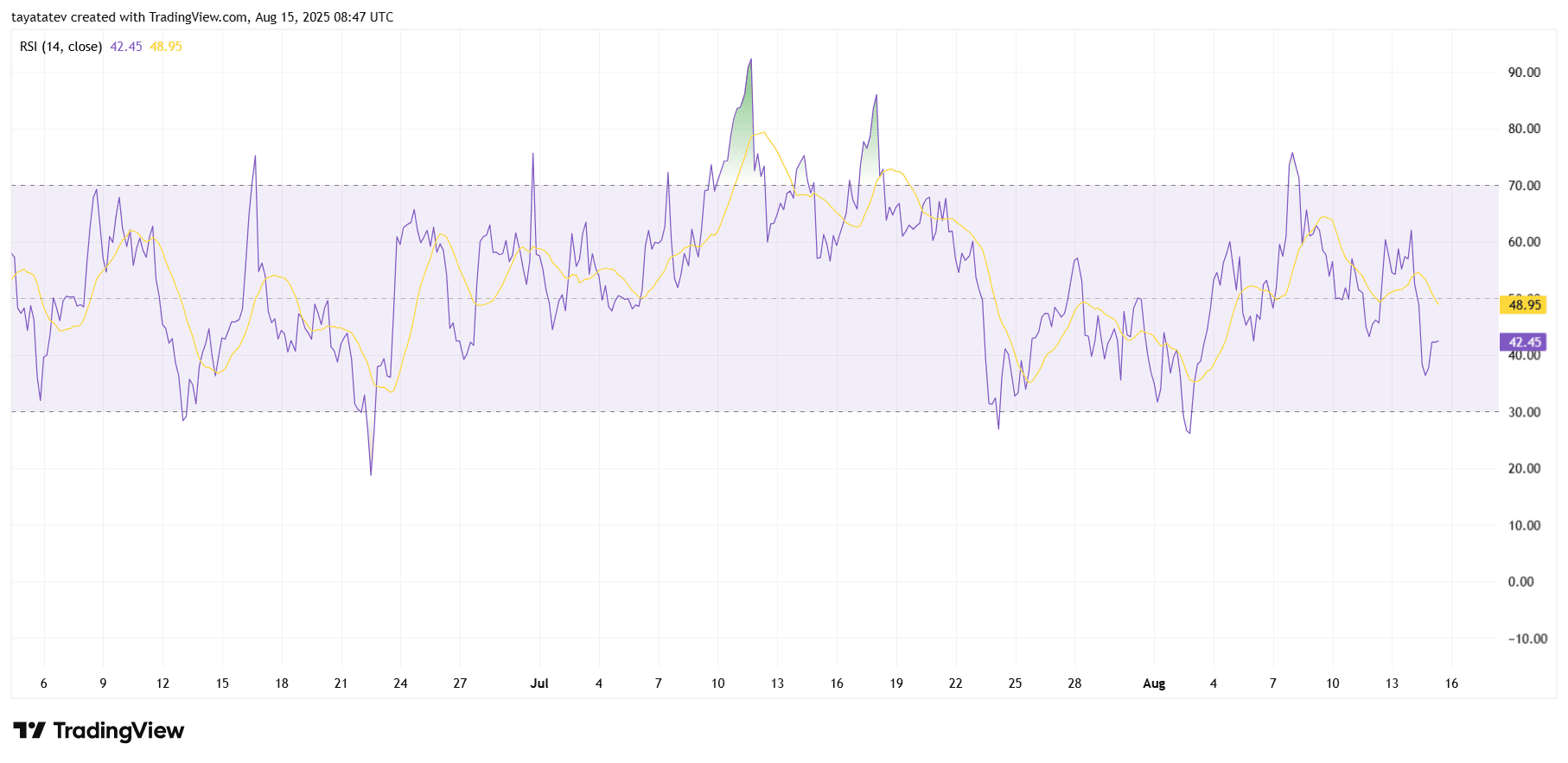

RSI Signals Cooling Momentum Before Potential Breakout

The 14-period Relative Strength Index (RSI) for XRP is currently at 42.45, while its moving average sits at 48.95. This gap shows that momentum has softened in recent sessions, with the RSI holding below the neutral 50 mark but still far from the oversold threshold of 30. The indicator has spent recent weeks oscillating between 30 and 70, a range that reflects balanced but shifting sentiment without extreme buying or selling pressure.

A reading near 40 often signals a cooling phase in a larger trend. Sellers are active, but they have not overwhelmed the market. In XRP’s bullish expanding channel pattern, this shows the market is pausing. The pause may come before a decisive move. A rise in the RSI above 50 would point to a shift toward buyers. A move closer to 60 would confirm stronger buying momentum. If this happens alongside a breakout above the channel’s upper boundary, the signal strengthens. Such a move would support the projected rally toward $5.17. Increased trading activity would add more weight to the bullish case.