Kanye West, also known as Ye, saw his $YZY token experience one of the most volatile debuts in cryptocurrency history. Within minutes of launch, the Solana-based token soared to a market capitalization of nearly $3 billion, attracting a flood of retail traders eager to speculate on the celebrity-backed project. However, the early momentum collapsed entirely. In less than 24 hours, the token’s market value crashed 100%, erasing all gains and leaving investors with tokens that rapidly lost their worth.

This complete collapse underscored how quickly speculative enthusiasm can wipe out capital in the memecoin sector. The sudden downfall left many investors who entered at the peak with total losses. The YZY case highlights the broader risks tied to tokens fueled mainly by celebrity association rather than lasting fundamentals.

On-Chain Data Highlights the Sell-Off

Blockchain records show that trading activity in the first hours of the YZY launch was intense. Large inflows of liquidity pushed the market cap to billions within forty minutes, but wallets tied to early insiders began offloading significant amounts shortly afterward. Analysts identified heavy selling pressure from a handful of large holders, which created an imbalance between buyers and sellers. That imbalance accelerated the decline and wiped out most of the token’s early gains.

Reports from trading platforms confirmed that as YZY’s value collapsed, its 24-hour trading volume remained high. Many investors tried to exit their positions or capture short-term moves, but the overwhelming trend continued downward. The sharp volatility reflected a typical boom-and-bust pattern often seen in speculative token launches, where early insiders benefit while retail traders absorb losses.

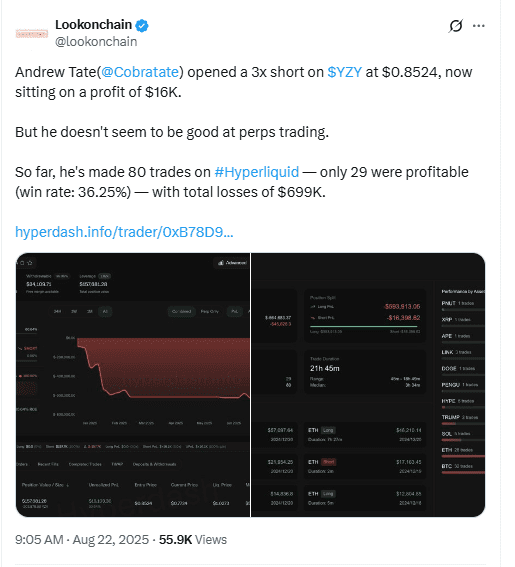

Amid this turmoil, high-profile figures also entered the market. Data shared by Lookonchain showed that Andrew Tate opened a 3x short position on YZY at $0.8524, securing a profit of about $16,000 as the token plunged. However, his broader trading record on the Hyperliquid platform reveals difficulties in perpetual futures trading. Out of 80 trades, only 29 were profitable, giving him a win rate of just 36.25%. His cumulative losses on the platform stood at roughly $699,000.

The presence of such leveraged trades underscored how YZY’s crash drew in both speculative buyers and aggressive short-sellers. The mix of insider selling, heavy retail losses, and opportunistic short positions magnified the decline, leaving the token effectively without support within a single trading day.

Celebrity Involvement and Market Reaction

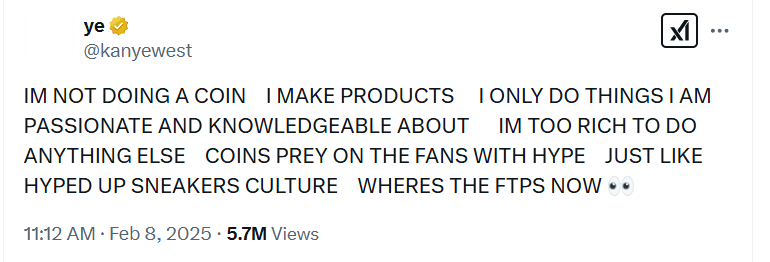

The launch came only weeks after Ye had publicly criticized memecoins, saying they “prey on fans.” Despite that earlier stance, the appearance of YZY with his branding quickly attracted widespread attention. Social media amplified the frenzy as influencers and traders circulated screenshots of early profits, fueling retail participation. Yet once the price collapsed, the same channels filled with complaints from investors who accused insiders of orchestrating a pump-and-dump scheme.

This reversal highlighted how celebrity tokens can generate short-lived hype but struggle to maintain sustainable value. Unlike established cryptocurrencies with active development and long-term roadmaps, celebrity-branded tokens often rely almost entirely on name recognition. Without underlying utility, such tokens remain highly vulnerable to sudden price swings when the initial excitement fades.

Industry Observers Point to Regulatory Risks

The YZY collapse also raised fresh concerns about regulatory oversight in the digital asset market. Analysts noted that large insider gains from quick sell-offs could draw scrutiny from agencies focused on investor protection. In previous cases, regulators have warned that celebrity-backed tokens may mislead fans into risky financial decisions. The U.S. Securities and Exchange Commission has already fined public figures in unrelated projects for failing to disclose paid promotions.

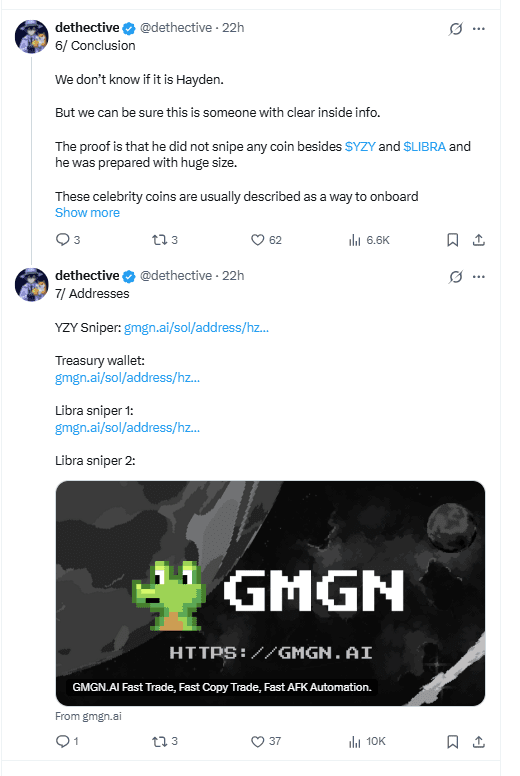

Industry experts warned that YZY could prompt further investigation, particularly if evidence shows that early insiders or associates benefited disproportionately at the expense of retail participants. Onchain analyst Dethective (@dethective) presented evidence of coordinated insider activity, tracing wallets that bought YZY at $0.20 with $250,000 capital and then cashed out nearly $1 million in profit within eight minutes. The funds were later linked to wallets active during the earlier LIBRA token launch, where insiders extracted an additional $20 million, bringing the total suspected insider profits to nearly $23 million.

Dethective concluded that the YZY launch showed clear signs of privileged access, pointing to wallets that only targeted YZY and LIBRA with unusually large capital. He warned that such patterns strongly suggest inside information rather than ordinary speculation. This onchain evidence strengthens the case for regulatory bodies to investigate whether celebrity tokens like YZY create unfair conditions for retail investors.

Lessons from the YZY Token Collapse

The $YZY token’s trajectory illustrates how quickly market dynamics can shift when speculation outweighs fundamentals. While the launch showcased the powerful effect of celebrity influence in crypto markets, it also demonstrated the dangers of hype-driven investments. Investors who entered early and exited before the collapse secured massive gains, but the majority who held onto their positions faced heavy losses.

The fallout from YZY now joins a growing list of celebrity token debuts that ended in rapid declines. Similar projects in the past have generated intense buzz only to collapse under the weight of insider selling and fading demand. The YZY case may stand out for its scale, given the billions involved in the first day alone, but it reinforces a pattern that has become familiar across memecoin markets.

As the dust settles, the YZY crash remains a stark reminder of the volatility and risks inherent in speculative tokens. It also underscores the importance of transparency and oversight in a sector where excitement can swiftly transform into losses within hours.