YEREVAN (CoinChapter.com) — Charles Schwab plans to roll out a spot crypto trading platform within 12 months. CEO Rick Wurster shared the update during the company’s recent earnings call. He said regulatory changes could soon allow direct crypto trading for Schwab clients.

“Our expectation is that with the changing regulatory environment, we are hopeful and likely to be able to launch direct spot crypto and our goal is to do that in the next 12 months and we’re on a great path to be able to do that,”

Wurster said.

Charles Schwab already offers exposure to Bitcoin futures and crypto ETFs. However, the upcoming platform would allow users to buy and sell cryptocurrencies directly. This change would place Schwab in direct competition with crypto exchanges like Coinbase and Binance.

Wurster also stated that interest in the company’s crypto-related products is rising. He noted this demand as a reason for the expansion into spot crypto trading.

Spike in Interest Around Charles Schwab’s Crypto Products

Charles Schwab has seen a 400% increase in visits to its crypto-focused pages. Wurster revealed this data during the earnings call. He added that 70% of this traffic came from people who are not Schwab customers.

This trend suggests high interest in Charles Schwab’s crypto products beyond its current client base. The firm believes direct spot crypto trading could attract new users.

Currently, Charles Schwab offers Bitcoin futures and crypto ETFs. The upcoming platform would expand the firm’s product lineup and enable direct exposure to digital assets.

The platform’s development follows broader shifts in investor behavior. More users are looking for access to digital assets through traditional brokerage firms.

Rick Wurster Ties Schwab’s Crypto Expansion to Regulation

Rick Wurster connected Charles Schwab’s crypto platform launch plan to ongoing changes in U.S. financial regulation. He pointed to the current administration’s efforts to create clearer rules for digital assets. These efforts include proposals and policy shifts from federal bodies that regulate financial markets.

One of the main regulatory players is the U.S. Securities and Exchange Commission (SEC). In 2025, the SEC increased its focus on how crypto assets are traded, stored, and offered to investors. The agency is also working on defining which crypto assets fall under its jurisdiction and what rules apply to them. This affects how companies like Charles Schwab can legally provide crypto services.

As regulation becomes more defined, Schwab believes it will be in a stronger position to enter the market with spot crypto trading. This type of trading allows customers to buy and sell actual cryptocurrencies, such as Bitcoin, in real time—rather than only gaining exposure through futures or ETFs.

Wurster explained that the company is ready to move forward once regulators finalize the rules. If conditions align, Charles Schwab plans to launch the platform before mid-2026. Until then, Schwab is keeping track of the latest updates from agencies like the SEC and preparing to comply with all required legal standards.

Charles Schwab Holds Custodial Role for Truth.Fi

Charles Schwab is already involved in crypto through its role with Truth.Fi. The digital investment platform is part of Trump Media and Technology Group. Schwab acts as the custodian for crypto products offered on the platform.

Truth.Fi plans to offer Bitcoin access, separately managed crypto accounts, and other digital asset services. Charles Schwab’s involvement in this project adds to its experience in handling crypto infrastructure.

The custodial relationship with Truth.Fi shows Schwab is already active in the space while preparing its own trading platform. The partnership could also support its internal product development process.

Industry Executives Respond to Schwab’s Spot Crypto Trading Plan

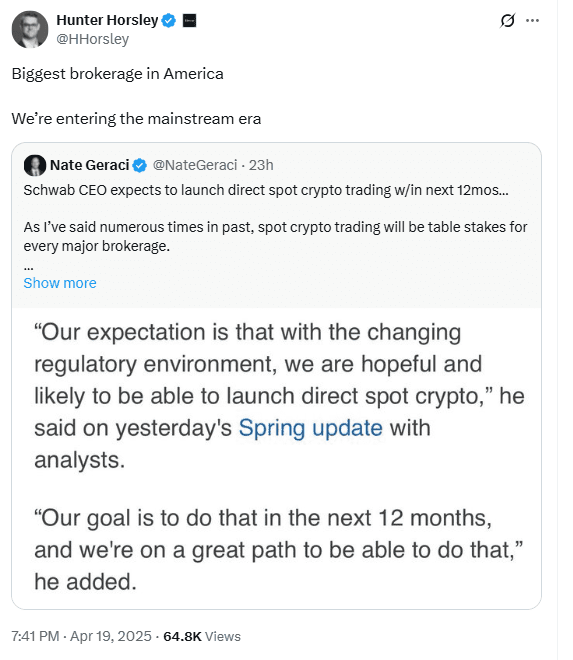

Charles Schwab’s crypto expansion received attention from other financial industry leaders. Bitwise CEO Hunter Horsley commented on the plan. He called it a milestone in digital assets gaining ground in the traditional financial sector.

Rachael Horwitz, Chief Marketing Officer at Haun Ventures, also reacted. She suggested Charles Schwab could explore crypto-collateralized lending in the future.

“Schwab should implement crypto-collateralized lending as part of its banking services next,”

Horwitz said.

Schwab has not confirmed any new crypto banking features. The focus remains on regulatory readiness and launching spot crypto trading by 2026.