Canary Capital’s spot HBAR exchange-traded fund is now available on Vanguard Group’s brokerage platform, giving investors a regulated way to gain exposure to Hedera’s native token through one of the world’s largest investment managers.

Vanguard manages about $11 trillion in global assets. It serves more than 50 million clients worldwide, making today’s rollout the first time Hedera has been exposed on a major US brokerage of this scale.

Vanguard Opens Access to ETF After Policy Shift

The HBAR fund, ticker HBAR, holds physical Hedera tokens and allows investors to buy exposure through standard brokerage accounts. It removes the need for crypto exchange accounts or self-custody wallets.

The ETF launched on Nasdaq in early November after receiving SEC approval. By late November, it held around $59 million in assets, with cumulative inflows now passing $82 million. US Bank handles custody for the ETF, while pricing is based on a benchmark derived from major HBAR venues.

Vanguard’s listing of HBR follows its recent decision to open its platform to third-party crypto ETFs. The firm, which previously avoided offering crypto products, now supports a range of digital-asset funds, including Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL) and HBAR.

You May Also Like: 5 Real-World Applications of Hedera (HBAR) You Should Know About

HBAR Price Jumps After Vanguard Listing

HBAR price gained about 9.1% during US trading hours on Monday, rising toward $0.145. Hedera’s market capitalization reached $6.13 billion as the listing attracted fresh attention.

The rally aligned with an intense session across the crypto market. Bitcoin climbed nearly 8% and moved above $90,000 after the US Federal Reserve ended its quantitative tightening program, easing liquidity pressure and boosting demand for risk assets. Ether held above $3,000, while Solana, Cardano and XRP also traded higher.

HBAR gained additional momentum from the ETF becoming available to Vanguard’s user base, providing a new entry point for investors who prefer regulated platforms. The ETF’s unit price also rose 8.45% on the day, while trading activity reached $1.68 million in value. Daily inflows accounted for about 12.31 million HBAR, adding clear evidence of token acquisition through the fund. As of Dec. 2, the ETF held $66.47 million in total net assets, with cumulative inflows reaching $82.04 million since launch.

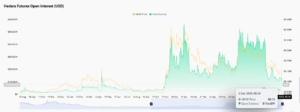

Despite the spot-market move, open interest tied to HBAR futures fell over the past 24 hours. CoinGlass data show that open interest has dropped from $131.9 million to $116.5 million, a 11% decline, signaling that derivatives traders reduced their positions rather than adding leverage during the rally.