We’re all down bad, but some, not just in financial terms but also morally.

Story One

Another presidential meme disaster

You’ll be relieved that this is not about Trump. Today, we’re talking about Javier Milei, the president of Argentina, a self-proclaimed techno-optimist, who is learning the hard way that not every president can get away with memecoin shenanigans. On Valentine’s Day, Milei tweeted about a coin called $LIBRA, which would supposedly fund the development of small Argentine businesses.

Within minutes, the token’s value soared from almost zero to $5 and a $4.56 billion market cap. A little later, Milei deleted his tweet, stating he had no connection to the project. The damage was done, and the token fell 97% as insiders cashed out.

Among these insiders is Hayden Davis, CEO of Kelsier Ventures and launch advisor to the Libra project. He now also holds wallets with $100 million in funds extracted from this rug, which he generously offered to Coffeezilla—a YouTuber normally exposing scammers—in a

It’s hard to say what’s more bizarre: a president defending himself against proceedings with phrases such as “I just shared it, I didn’t promote it” or the fact he didn’t bother doing any due diligence.

Takeaway: Memecoins aren’t remotely funny anymore. , my favorite Finance Youtuber: “They’re like the greater fool theory but for bad jokes.”

Story Two

North Korea max extracting

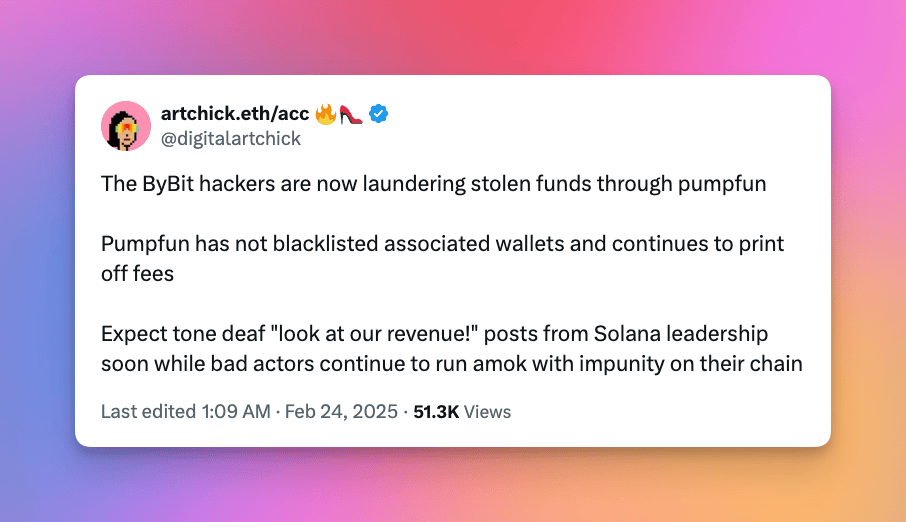

Outside of bizarre ideas such as “you gotta snipe before the sniper bots do it” (which is crypto bro speak for front-running the front-runners), Hayden Davis also gave us the term , which is what Lazarus did to ByBit last weekend.

In the largest exploit of crypto history (so far), hackers managed to transfer 400,000 ETH (worth $1.4 billion at the time) from the exchange’s cold wallet. The most likely explanation remains that the hackers managed to mask the transaction, which lured ByBit executives into signing what looked to them like a normal business transaction.

Fortunately, ByBit made sufficient funds from liquidating derivatives traders in the past to fill the hole in the balance sheet.

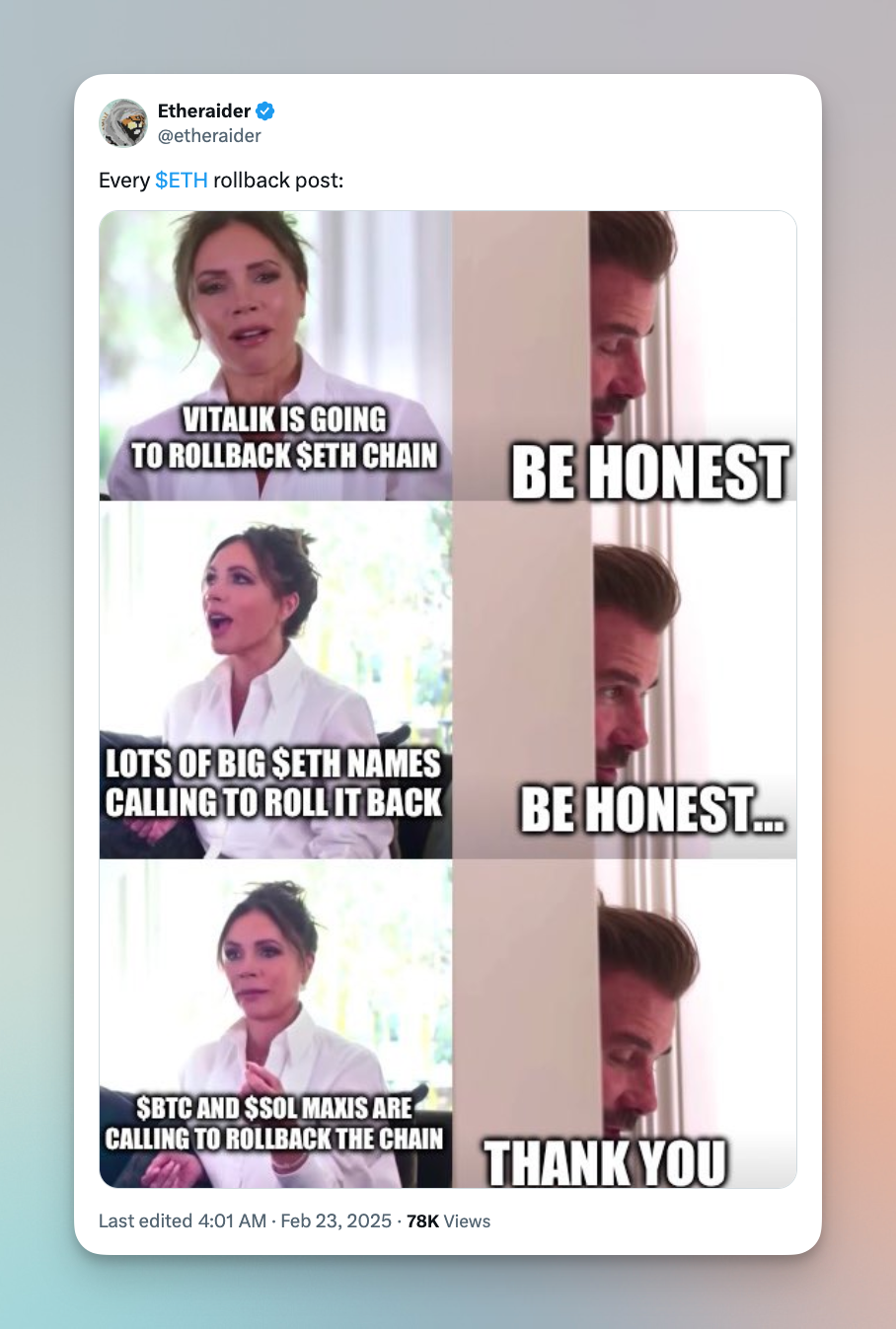

As soon as it was clear that Lazarus was behind the exploit, some Bitcoin and Sol maxis started calling Ethereum to roll back the chain as if they’d suddenly been converted to compliance officers who couldn’t be more concerned about terrorist financing.

Takeaway: Isn’t it ironic how Bitcoiners give up their values of credible neutrality and censorship resistance when it’s about another chain? To the Solana maxis who tried to use this to establish their superiority, be careful what you wish for…

Story Three

Shame on you

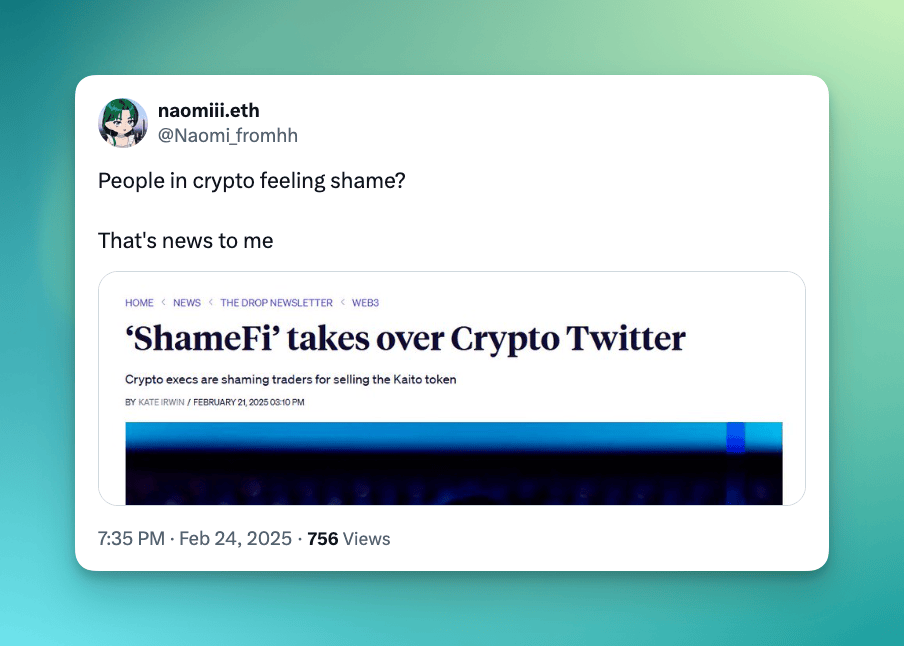

This has become such a frequent message that someone coined the term ShameFi to frame the shaming of people selling their Kaito Airdrop. Kaito AI is a data analytics platform that assigns people tweeting about crypto with a score.

For the people not as chronically online, this is what yap means.

The more “yaps,” the more points and generational wealth these people would get. That belief drove much of CT discourse down the mindless pit, where anyone could fake their excitement about Kaito to raise the ranks. Unfortunately, the AI isn’t smart enough to differentiate between quality posts and ChatGPT garbage.

This might be to blame for the mixed reactions to the airdrop. It turned out that people with a large following got preferential treatment—hello, meritocracy, my old friend—and that being aligned with Kaito was more important than anything else.

Since your account is linked to the wallet, it’s pretty easy to figure out who was selling, so the shaming began with Nansen CEO Alex Svanevik (also an analytics tool btw) sharing who was selling using Nansen dashboards.

Takeaway: I doubt ShameFi will achieve anything. Crypto’s lack of shame is to blame for 90% of the problems we have. And if projects don’t want people to sell tokens, then maybe create a compelling reason not to. I, for one, regret all the airdrops I didn’t sell.

Fact of the Week: It might have shocked the Argentine public that their president views them as exit liquidity, but at least they are prepared to deal with this trauma. Argentina has the world’s highest number of psychologists per capita, with 286 per 100,000. In comparison, Australia has 103.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: .

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).

EU residents: CoinJar Europe Limited (CRO 720832) is registered as a VASP and supervised by the Central Bank of Ireland (Registration number C496731) for Anti-Money Laundering and Countering the Financing of Terrorism purposes only.