Most Western companies and investment funds will have cut their ties with Russia in the last few years, but events there do have a bearing on the rest of the world so it is important to consider how events may unfold in the immediate future.

Russia launched its War with Ukraine in February 2022. This article looks at its economic fundamentals prior to launching the Ukraine War and considers what the likely impact of the conflict has been on its economy.

In general terms most Western countries have pulled out of the Russian market but their businesses or franchises have been taken over by local or Asian companies and carry on with little disruption. In terms of manufacturing (e.g. truck making) it is a little more complicated owing to compatibility of designs, parts etc. Most Western manufacturing companies operated joint ventures with Russian partners but these are suspended. The space is being filled by Chinese companies but they may be bypassing the existing manufacturers and establishing their own supply chains.

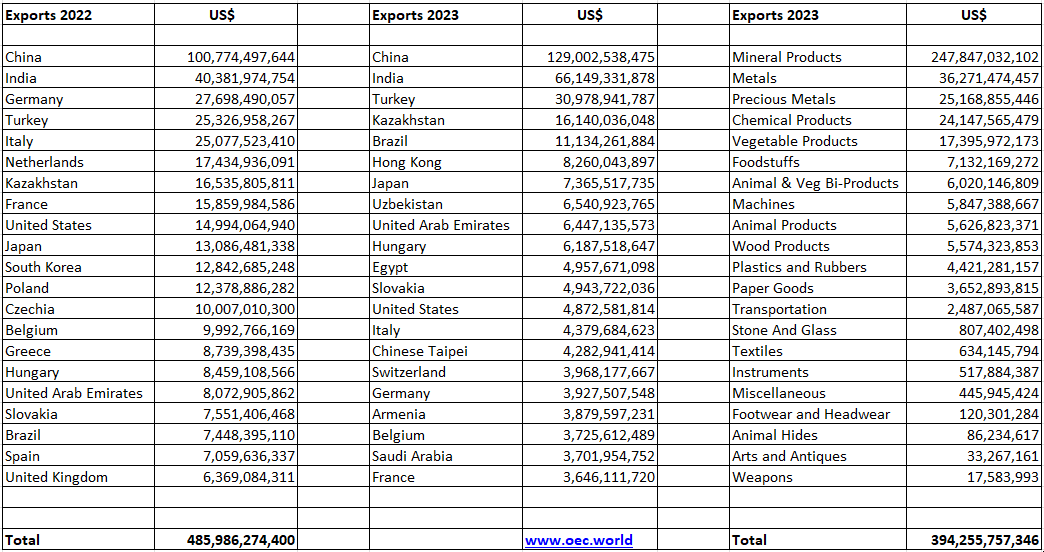

With regard to exports there is significant disruption to Russian sales of oil and gas to Western Europe, though they continue to some extent. As these are commodities of universal value they are not so sensitive to sanctions as manufactured products and Russia has been able to find new sales outlets in China and India though with some contraction in overall sales.

Russia’s exports, including before the Ukraine War, were overwhelmingly of primary products with manufactures confined to a few specialized sectors. This is the export profile of a developing rather than a developed country. The exports of peers such as Turkiye, Poland etc are now overwhelmingly manufactures reflecting their integration to the EU and other markets. Russia has a large manufacturing sector which was/is a supplier to the domestic market.

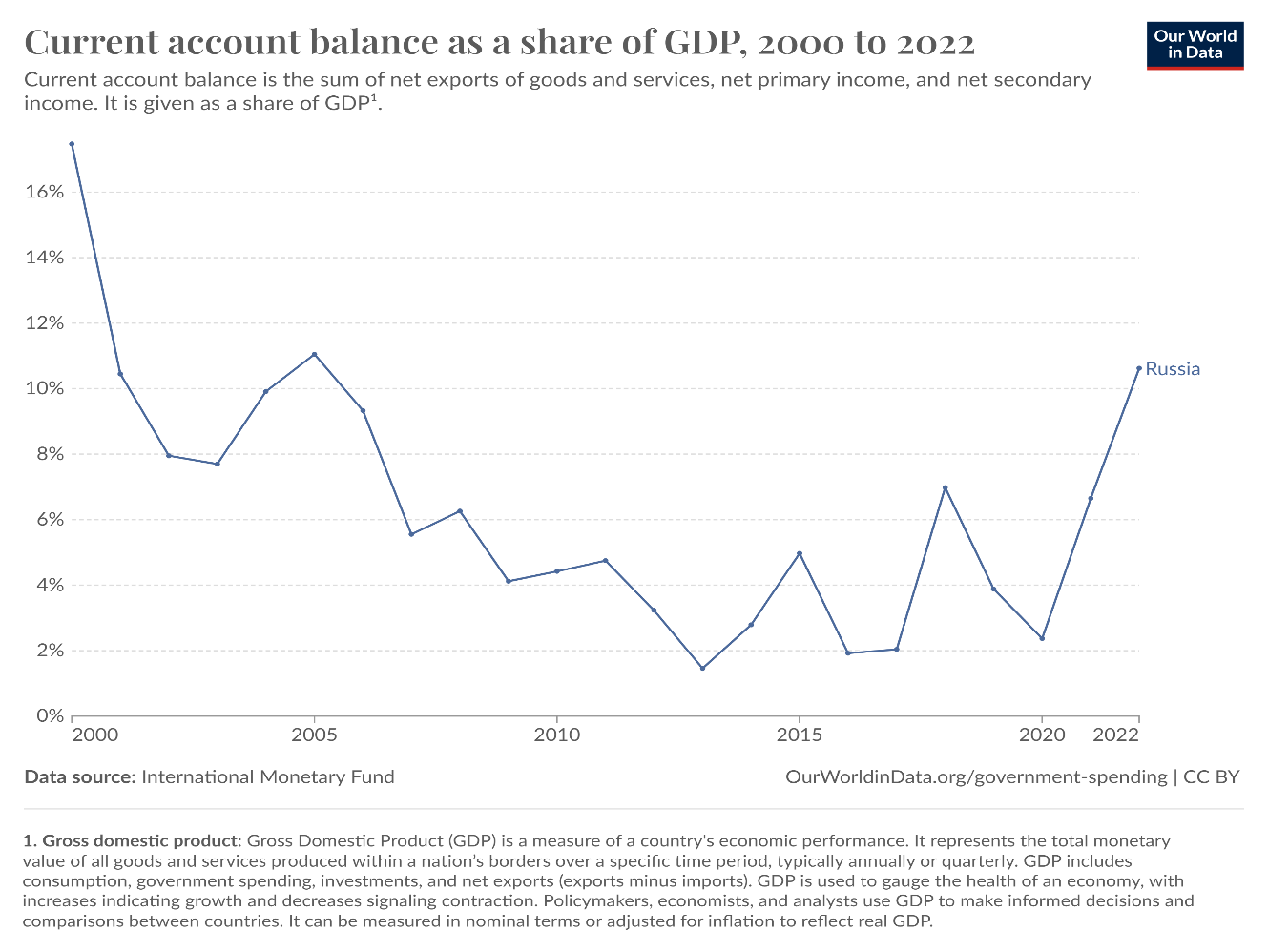

One striking indicator of the Russian economy is that its Current Account has been continuously in surplus since the Millennium. What this means is that Russia has very little State external debt and, in fact, had accumulated an important surplus of foreign assets before some of which was frozen following the outbreak of the Ukraine War.

This table shows that overall exports have fallen by about a fifth from 2022 to 2023 – the first full year of the Ukraine War but that exports to China and India have increased. Some of the decrease will be due to the lower price Russia gets for its oil and gas and the remainder due to the decline in trade with Europe. Imports in 2023 were at US$208bn, according to the same data source, so there was a substantial trade surplus.

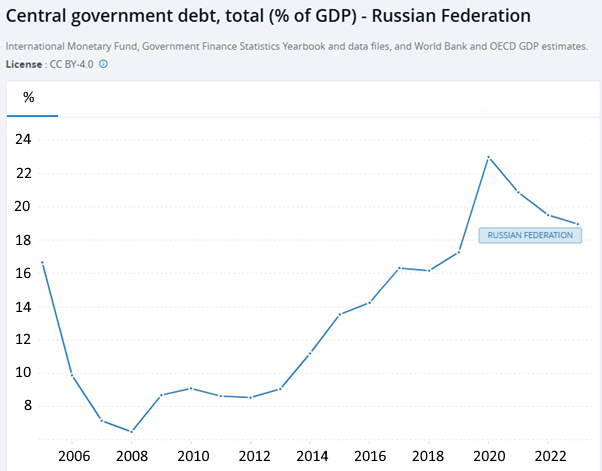

Russia, before the Ukraine War, had a very low debt/GDP ratio.

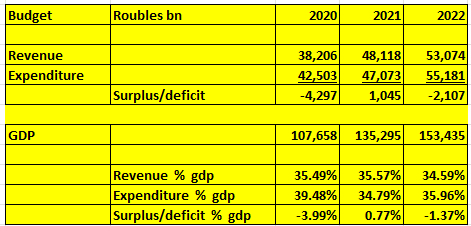

Note that Russia’s 20% debt/gdp ratio compares with ratios of 80-120% in the US and many EU countries. Russia’s debts from the 1990’s were burned off by the hyperinflation but since the Millennium inflation has been under control and the low debt ratio reflects prudent fiscal management. The deficit was relatively elevated in 2020 but this was similar to other countries due to the Covid downturn.

www.rosstat.gov.ru Statistical Yearbook 2023

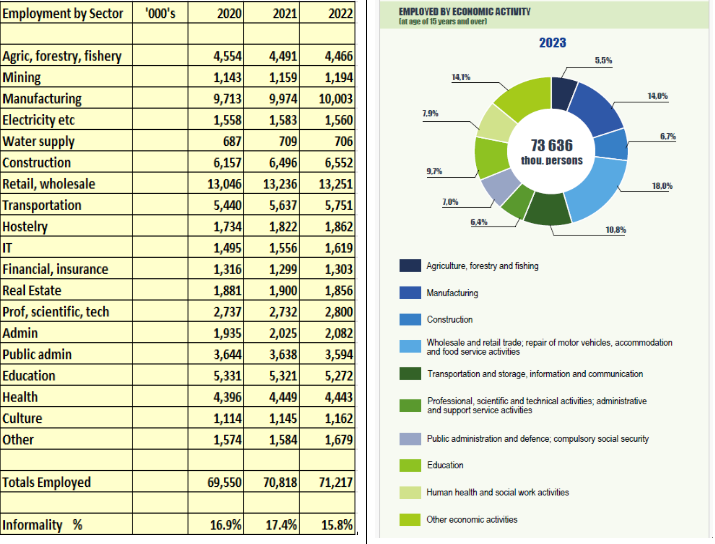

Employment in Russia is quite diversified by sector:

Note that manufacturing employment, at 10m in 2022, was 14% of total employment and manufacturing, mining and agriculture combine some 22% of the total. Construction jobs were 9.2% of employment.

One of the striking things about the data is how strong Russia’s vital statistics were prior to the outbreak of the Ukraine War in terms of public finances, employment diversification and formality, housing construction etc. Compared with countries such as e.g. Argentina & Brazil who also stumbled in the 1990’s it was Russia who overcame its problems whereas those two countries are still struggling to balance their government finances.

This is all the more remarkable since the institutional legacy left by the former Soviet Union was null and everything had to be built from scratch. On the economic front one weakness is the low level of manufacturing exports. On the institutional front Russia exhibits occasional signs of authoritarianism such as how it deals with dissidents, not to mention how it ended up in a War with Ukraine.

The question of how Russia’s economy is coping with the Ukraine War is difficult to answer as there is insufficient data in the public domain. Some points to note:

- Curtailment of exports to Europe and redirection to Asia with some reduction in volumes and prices

- Abandonment of Russian joint ventures by Western companies with some disruption to supply chains but space filled by Chinese companies

- Labour market strain of conscription for Ukraine War

- Cost of military equipment but also boost to military output

- Inflationary pressures due to effect of War on public finances and possible shortages (undetected in data above)

Russia entered the Ukraine War with its public finances and external accounts in excellent health so there is probably some way to go before it is really under pressure.

Russia’s armed forces personnel have increased from about 1m to 1.5m from Feb 2022 to today. The IISS estimates that as of Jan 2025 Russia had a minimum of 172,00 soldiers killed and 611,000 wounded in the conflict up to that time. (IISS 10feb2025). Considering that there were 71m employed in 2022 and several million inactive this increase does not yet indicate significant labour market disruption.

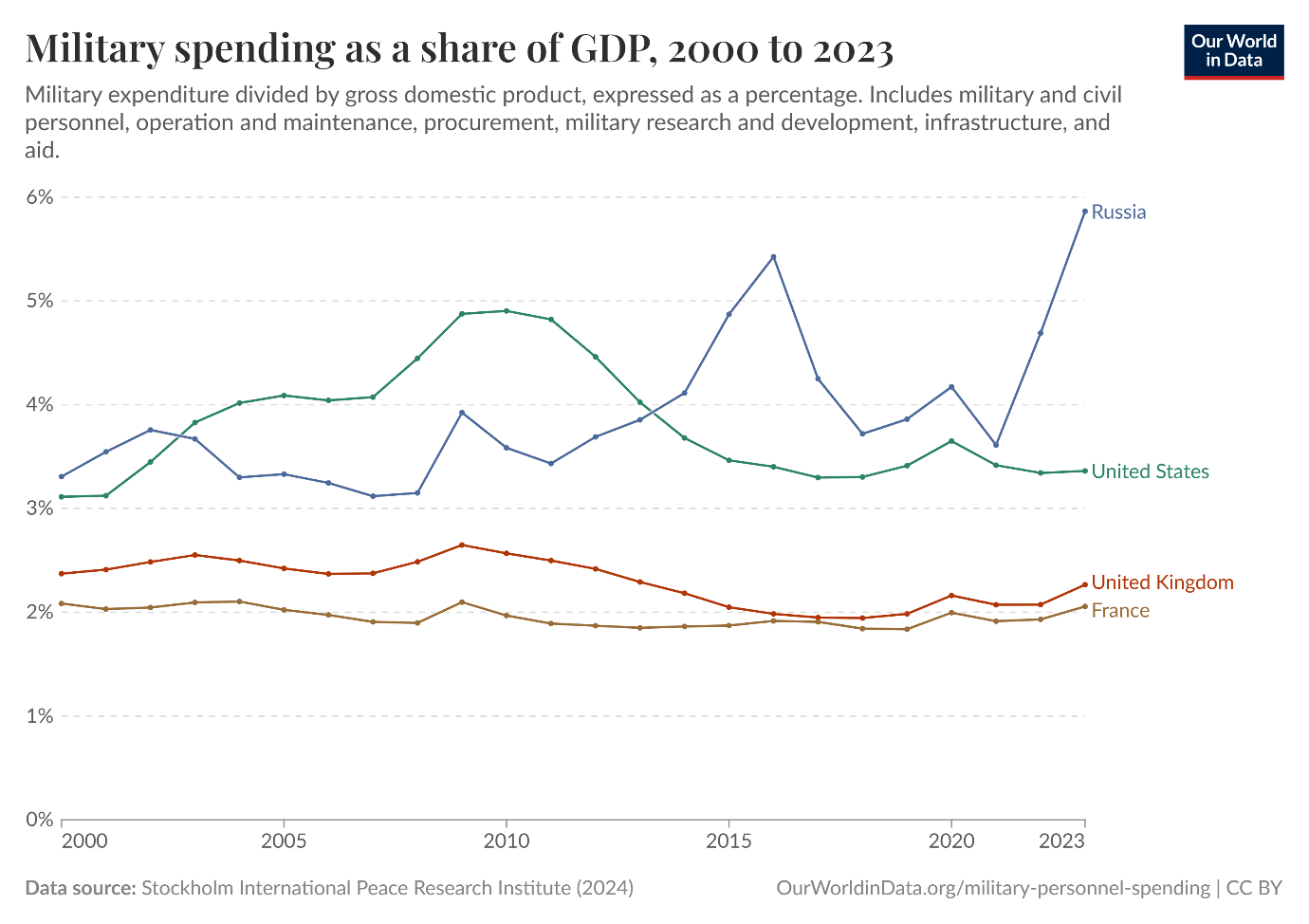

SIPRI – April 2025 (military_spending_in_russias_budget_for_2025) estimate that defense spending in 2025 will be as much as 7.2% of GDP. It is worth noting that since Russia sources most of its military hardware locally the increase in military spending actually boosts the domestic economy.

If we look at the current situation from Russia’s point of view we have:

- From the data it appears that the Russian economy can comfortably sustain the conflict for a number of years more.

- China gains from becoming the preponderant power in Russia that may give Putin pause as in the long run Russia does not want to become China’s pawn

- Russian casualty figures may be causing some disquiet but the nature of the political system may be such that this does not lead to pressure on the regime

- It seems unlikely that the US will contribute more money to Ukraine so they will have to settle with Russia sooner or later

- Probable NATO acquiescence under the Trump Administration to Russia retaining conquered territory in Eastern Ukraine and the Crimea with eventual legal recognition

Read our full report at https://www.marketresearch.com/Latin-Report-v4296/Economy-Russia-39205743/

Paul Dixon is the founder of Latin Report. His economics articles on a variety of topics are very widely read and are often found ranking in search results for months and even years after being first posted.

Latin Report tries to make sense of the vast volume of information available to understand country economies. Our reports are written from a long term perspective and track a country’s evolution over a number of decades. We mostly let the data tell the story with commentary on political events to illuminate features of the data. Latin Report aims to express views that hold their value over time and should therefore assist companies making long term decisions. This compares to competitors’ reports based on current analysis which are subject to continual revision. https://latinreport.eu