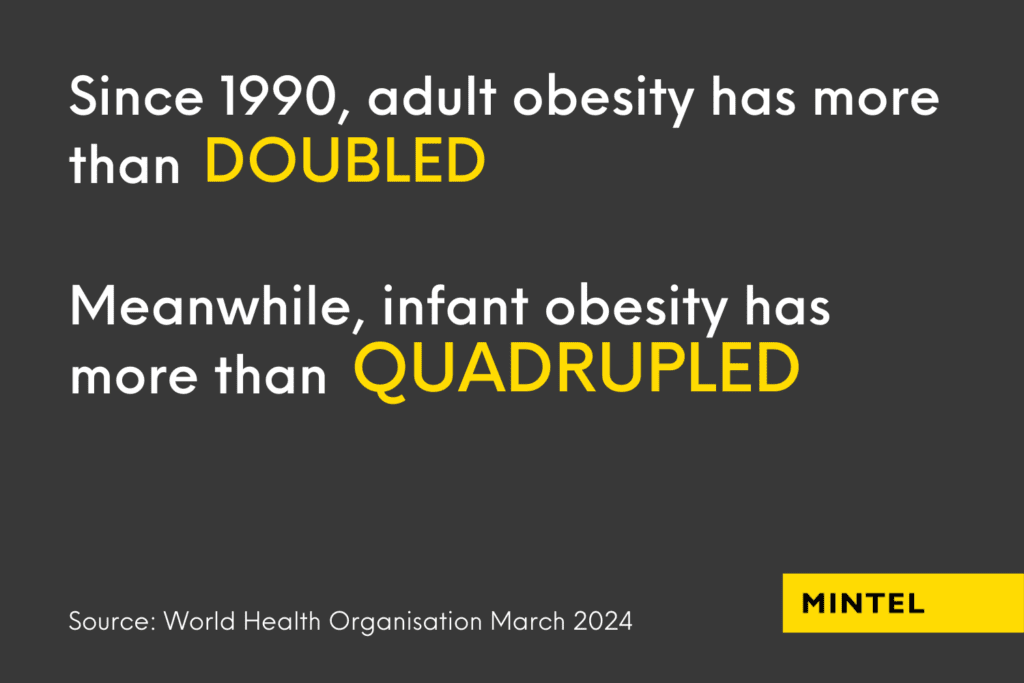

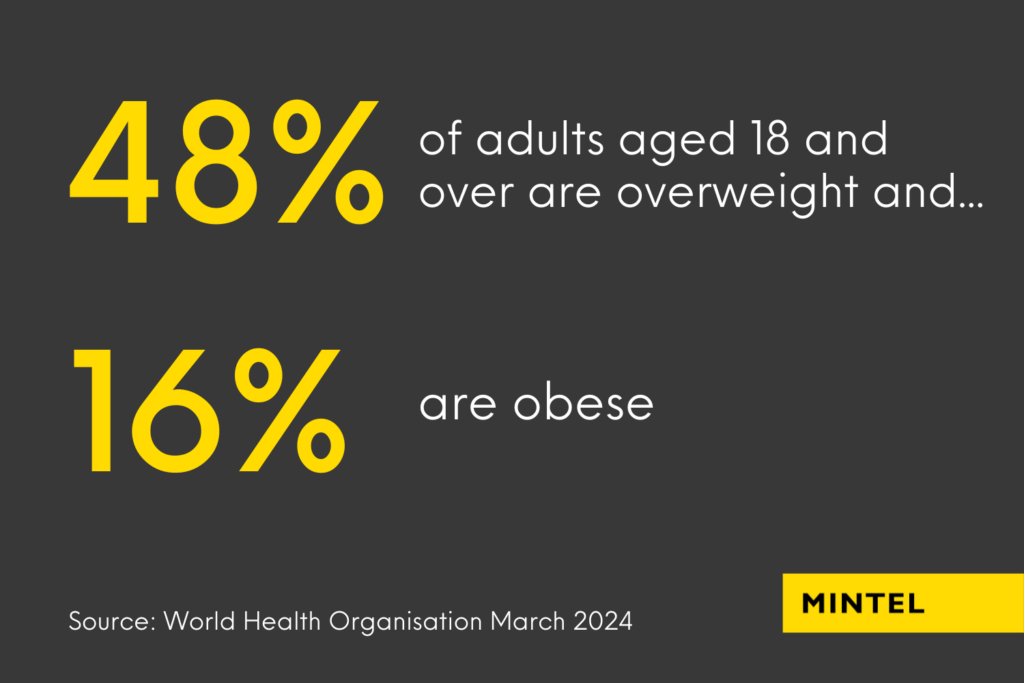

Obesity is arguably the defining health issue of the 21st Century. World Health Organisation data shows that 43% of over-18s are overweight, and 16% are obese. In the US, the adult obesity rate is far higher than the global average, at 43%, with an incalculable impact on the nation’s health, quality of life, and economic wellbeing.

There is a long history of medical interventions designed to help people control their weight, none of which have halted the rise in obesity. However, the emergence of several drugs that mimic the effect of the GLP-1 hormone —including Ozempic, Wegovy, and Mountjaro— is probably the most promising avenue so far.

The early indicators of the Ozempic weight loss era

Predictably, these drugs are attracting huge industry and media attention. Our Senior Consultant, Vivienne Rudd discussed the impact on the beauty market with Cosmetics Design Europe. Additionally, I was recently asked by BBC News to discuss how these drugs are affecting consumer-facing industries, how they’re driving the conversations that we’re having with our clients at Mintel, and the broader implications for society. Watch the interview below.

This BBC interview barely scratched the surface of what Mintel is already learning about the drugs’ influence. Throughout this article, our Mintel Consultants Vivienne Rudd and Jonny Forsyth —our Senior Director of Mintel Food & Drink— provide insights on consumer-facing industries, highlighting the broad-based changes we’re noticing.

The US leads the way when it comes to the use of these weight loss drugs, even though Ozempic is technically only approved as a diabetic treatment in the US. Mintel’s Weight Management Trends Report shows that 15% of US adults who are currently trying to manage their weight are using one of these drugs, and 21% are interested in doing so in the future. The drugs are less readily available in many other markets, but consumer interest is still huge. In the UK, for example, 25% of adults would be interested in using injectable weight loss drugs.

As anyone who’s ever struggled to maintain a healthy weight will confirm, it’s a lot easier (and more enjoyable) to gain weight than losing it. We’re surrounded by easily accessible, affordable and delicious food, and busy lives mean that finding the time and willpower for exercise is hard. It’s no surprise that GLP-1 drugs have seized the public’s imagination.

Recent Mintel research covers the impact of GLP-1 drugs on the food and drink industry (client access only) and our findings point out that previous attempts to “medicate away” obesity have failed. The likes of Ozempic could follow a similar path: initial excitement at the idea of a “magic bullet” followed by disillusionment.

But the sheer scale of the obesity crisis means that if (and it’s a big “if”) the GLP-1 drugs do have a sustainable impact on weight control, the impact will go way beyond health. From fashion to foodservice to leisure, it’ll affect a huge segment of consumer spending.

“Every bite counts”

One concern linked to GLP-1 use is the impact of a reduction in food consumption on nutrition. Simply put, if people are eating less, they need to be sure that they’re still getting the nutrients needed to maintain their health.

One specialist nutrition brand who is leading in the functional food sector is Abbott and their launch of Protality, a high-protein, low-fat and -carbohydrate shake designed to combat potential muscle loss from medication usage.

Dietrary supplement company Herbalife has also launched nutrition products designed to support GLP-1 users. In retail, global dietary supplement retailer GNC was the first to launch an in-store GLP-1 support program to combat medication side effects.

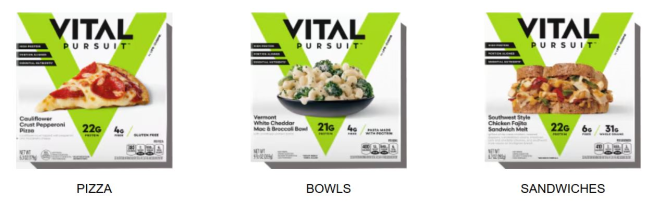

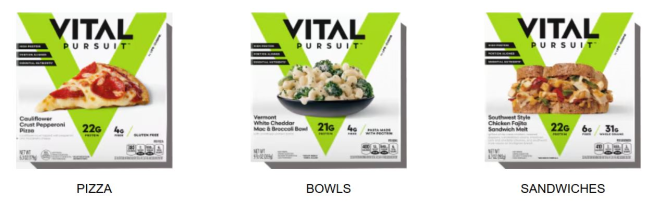

However, there’s another approach to this expanding issue. Several food brands are creating meal solutions in response to the Ozempic era that designed to pack the maximum amount of nutrition into smaller portions. In May 2024, Nestlé introduced Vital Pursuit, a line of foods designed to be a companion to GLP-1 users, and plant-based frozen meal delivery service Daily Harvest has taken a similar approach.

GLP-1 has the potential to rewire multiple sectors

There have been plenty of disappointments regarding weight loss solutions. Initial excitement fades, and obesity continues to rise. At Mintel, we are not medical professionals, so we cannot judge whether GLP-1 drugs will follow a similar trajectory to previous miracle cures.

However, Mintel is an expert in predicting trends in market dynamics, innovation, and consumer behaviour. Ozempic and similar drugs will have a huge impact on multiple markets if they deliver on current expectations.

Food and drink will be at the forefront of market disruption

Most obviously, they will shift consumer preferences and innovation in the food and drink industry. Fundamentally, GPL-1 drugs work by reducing appetite and cravings and, in turn, reducing the number of calories that people are consuming. And the easy assumption would be that fewer calories consumed will mean lower sales for food and drink brands.

In reality, though, there’s zero chance that food brands will sit back and watch this happening. It’s one of the most relentlessly innovative consumer-facing sectors, and those innovation teams are already starting to respond. The alcohol sector, for example, shows how innovation and premiumisation can preserve value sales even where volume is falling.

Importantly, brands have some breathing space to formulate the most effective response. Even in the US, only a minority of consumers are using these drugs, and they’re even more niche outside that market. Cost, supply chain challenges and regulatory issues mean that the full impact isn’t going to be felt for years. That doesn’t mean that brands can afford to sit back though, especially as so many of the possible responses fit so well with existing trends in the market.

“Less but better” food and drink innovation

GLP-1 drugs open up multiple avenues for innovation, many of them centering on the idea of “less, but better”. Nestlé’s launch of Vital Pursuit points the way: high-quality, nutrient-dense products designed to make sure that people are still getting the nutrition they need even if they’re consuming fewer calories. This concern about maintaining nutrition on a lower calorie intake will push through into innovation around supplements, and a blurring of the boundaries between pure supplements and functional food.

The impact of GLP-1 drugs is likely to be most disruptive in the snacking sector. Brands have been endlessly inventive in creating new consumption occasions and products that satisfy our need for a quick pick-up. GLP-1’s impact on satiety and the reported reduced user cravings will hit habitual snackers’ tendency to graze mindlessly.

But again, “less but better” could help maintain the sector’s value. Any of us who struggle with willpower know that that recommendation to “satisfy your cravings with one or two squares of really good dark chocolate” is wishful thinking. For many of us, if that bar of chocolate is going to be opened, then it’s going to be finished in one sitting. Maybe Ozempic is the willpower boost we need to eat like a wellbeing influencer finally?

Importantly, these are all innovation trends that Mintel has been tracking and recommending for some time. Food as medicine, less but better, high protein, more mindful snacking – they’re all product positionings that already resonate with consumers, whether or not they’re using GLP-1 drugs. What the likes of Ozempic will do is maintain the momentum of these trends.

The beauty and personal care industry will also be impacted

It’s not just food that will be affected. My colleagues on Mintel’s Consulting team, Vivienne Rudd and Alisha Taylor, have already done extensive work to understand and predict the impact on the beauty sector. In particular, there’s room for innovation to counteract “Ozempic face” – the term used to describe rapid weight loss’s impact on skin firmness and glow.

Using the US as a test market, they used advanced data analytics to track the prevalence of collagen increasing and plumping claims in new beauty and personal care product launches. That analysis found that the claims are still relatively niche, but that they’re growing significantly.

Challenger brands are already responding. At the Cosmoprof Las Vegas trade show last year Vivienne and Alisha spotted examples of products claiming to combat collagen depletion. The big opportunity for the industry leaders is to use their innovation expertise to create science-driven formulations, and then their marketing muscle to raise awareness of these claims in the broader market.

Looking further ahead: a societal shift?

When you look past consumer packaged goods (CPG), the impact of GLP-1 drugs is less easy to predict – but arguably even more disruptive. Food is central to so many areas of the human experience. It’s not just fuel. It’s how we care for ourselves, and for the people we love. It’s at the heart of how almost every culture socialises. If our attitude to food changes, then so will multiple industries.

Foodservice and the broader leisure sector, for example, is already being affected by changing attitudes towards alcohol consumption. In the UK, we’ve seen a move away from our traditional emphasis on alcohol-facilitated social activities, and a growth in the likes of escape rooms, competitive socialising, and dessert bars.

Ozempic could lead to even greater disruption. Going out for dinner will be much less appealing when half the table has dramatically reduced appetites and spends the meal pushing a half-finished pizza around their plate.

Want to know more? Just ask us

Here at Mintel, we are experts in innovation. We’re already identifying many of these trends through our expert analysts and by tracking product launches on our global new products database (GNPD). From changes in ingredient and claims architecture to broader scanning of consumer trends, Mintel Consulting can help you identify what’s already happening in your sector, predict what’s coming next, and understand what it means for your business’s strategy.

Get in touch today with Mintel Consulting to learn more about how we can use our methods to help drive your growth strategies.

Contact a Consultant