In an interconnected economy, tariffs don’t just shift trade – they have the potential to rewrite the rules of business operation across the US market and significantly change consumer behavior. And as always, during periods of change, we’ve built cross-category teams of analysts and senior Mintel Consultants who are working diligently to predict what tariffs will mean for companies in relation to consumer demand, market dynamics, and innovation strategy.

Predicting the impact of the tariffs is complex. The policies continue to evolve, and the situation remainsis fluid. At this point, most markets are facing a 10% baseline tariff, which is a shift from the original proposals first put forth by the administration. Further changes are possible.

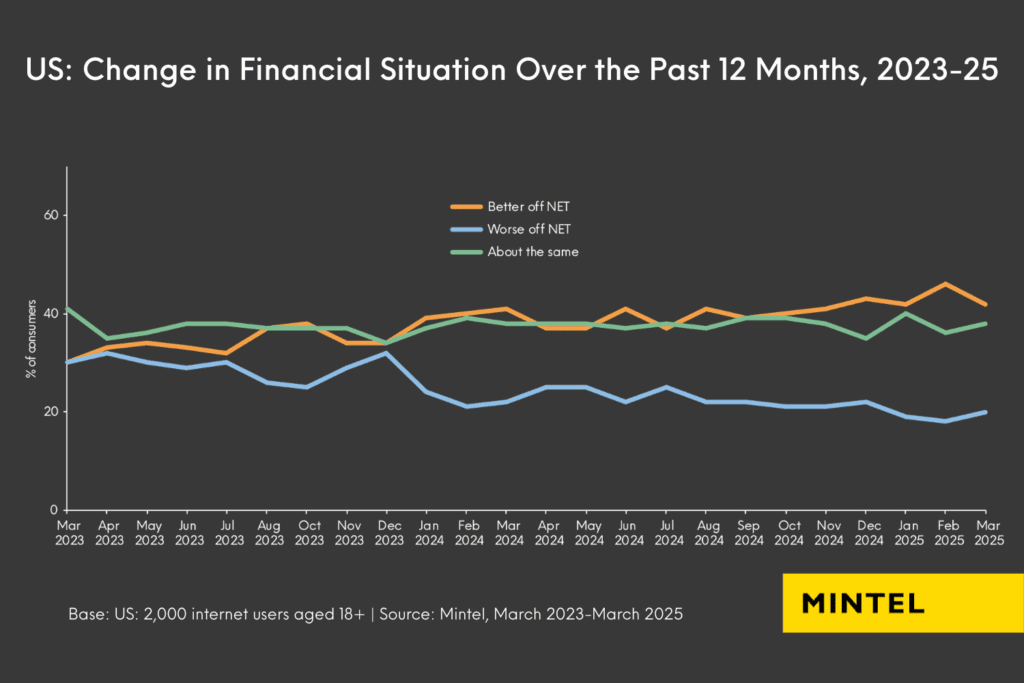

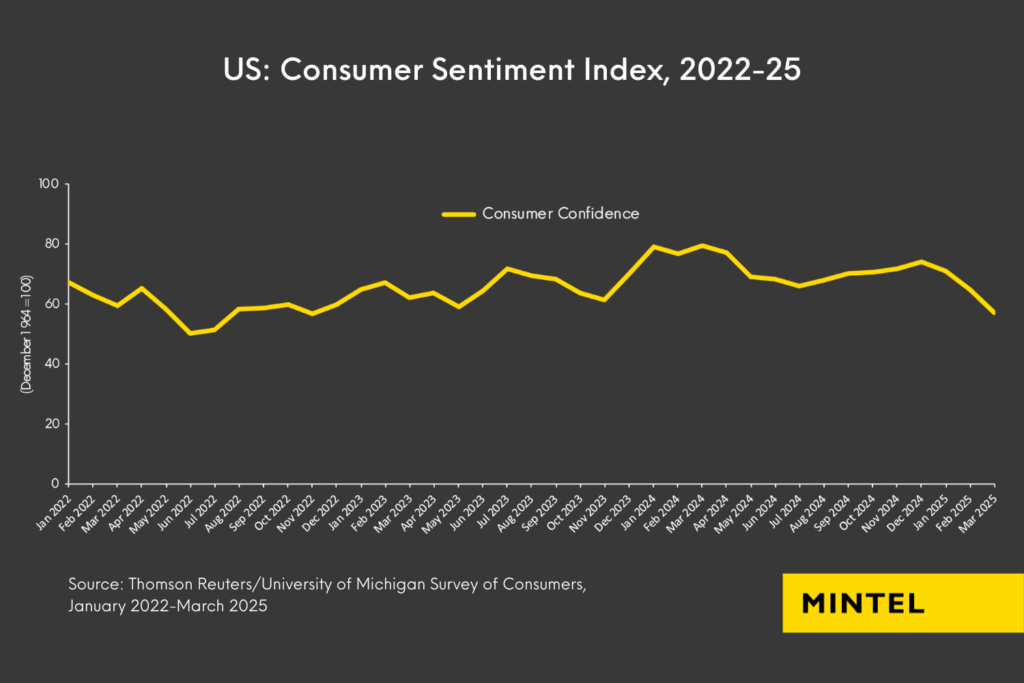

The impact of the tariffs goes beyond the direct costs to importers. The turbulence has affected financial markets and introduced a new period of uncertainty for businesses and consumers. In periods of uncertainty, consumer behavior, preferences, and attitudes have the potential to change and evolve.

However, periods of uncertainty can also be periods of growth and opportunity. They force us to rethink strategies, reimagine possibilities, and connect with consumers in new and meaningful ways.

Drawing lessons from the past to inform strategy today

Every time there have been periods of uncertainty and major global events, Mintel’s research and data over the past several decades reveal common themes and patterns of behavior from both consumers and businesses.

The greater the level of uncertainty in the US market, the more that businesses and consumers try to establish a sense of control by closely evaluating their spending.

This reevaluation almost always leads to reducing spending wherever possible. When uncertainty takes hold, it makes sense to try and create a margin of safety and prepare for the worse-case scenario.

Three key behavioral shifts to take advantage of

As we embark on this period of fluidity and uncertainty, here are three behaviors to anticipate from consumers in the coming months (and possibly years):

- Value and efficacy are top priorities… And consumers will trade up and down

Consumers will be more mindful of their spending and seek ways to save money while maximizing value. Value has been important to US consumers for some time, and that importance accelerated in 2021 with the post-COVID-19 inflationary period. Value no longer means the least expensive option in a category or industry. Genuine value ultimately comes from trust, efficacy, and relevance to a consumer’s life.

As consumers aim to balance value and efficacy with reducing spending where possible, they will make adjustments to their purchase decisions. Many opt to trade down to a private label brand or validated lower “dupe” brand that can give them the same quality and performance, but for a lower cost. A number of retailers, such as Target and Walmart, have invested heavily in expanding and improving the quality of their private label brands in the past few years, and are well positioned for this period of uncertainty. A significant 68% of US consumers agree that store brand items offer better value than brand name items, and some 61% agree that brand name items are not always higher-quality than store brands. These Mintel findings underscore that the investment retailers have made in their private label brands has paid significant dividends.

While trading down tends to be a more common practice in periods of uncertainty, trading up does happen, as consumers find ways to “treat” themselves in certain categories. In addition, consumers will also spend more in certain categories if they think that’ll give them a better return on their investment. That includes spending now to save later, as consumers fear sudden price increases, especially in key categories, such as technology and cars.

- Consumers will gravitate towards the familiar

In periods of uncertainty, consumers gravitate toward the familiar as another anchor and means of control. During the COVID-19 era, consumers gravitated toward tried and tested, long-standing heritage brands across categories, showing less interest in trying new brands.However, post-pandemic, consumers shifted back to being open to new and emerging brands, and many mainstream heritage brands have lost market share to new and disruptive brands across categories in the post-COVID-19 era. There are countless examples of this, including Poppi and Olipop in carbonated soft drinks, Native in deodorant and other personal care categories, Scrub Daddy in cleaning tools, and SmartSweets in candy.

Nonetheless, in the current climate, consumers may swing back to favoring tried and tested heritage brands that have proved their value versus taking a risk on a new or unknown brand that they or their family may not like, resulting in a waste of money. A large majority of 69% of US consumers agree that they trust brands that have been around for a long time more than new brands.

The shifting economic landscape in the US may also make it more difficult for new brands to emerge and find success the way they have in the past decade. While the expansion of social media and e-commerce has significantly reduced the barrier of entry for a new product or brand in numerous categories, factors like tariffs may impose supply chain and operational barriers that are difficult for new players to overcome. Mainstream heritage brands, most of which are based in the US, are better positioned to weather this period of uncertainty with their superior operations and infrastructure, which will make it easier to make any necessary adjustments.

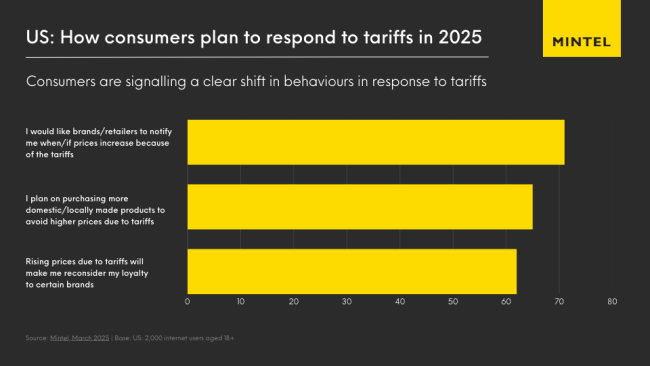

- Transparency will be more critical than ever before, and consumers will expect it

Over the past 20 years, communication technology and social media have reshaped the way consumers connect, share information, absorb news and influence one another, emerging as some of the most transformative forces in modern society. These forces, in combination with this period of uncertainty, means that business actions are more visible than ever. Consumers will hold brands accountable in real time. To navigate this, brands need to lead with transparency and proactivity when communicating about price increases and product changes (such as changing a formulation to use a domestically sourced ingredient) that impact consumers.

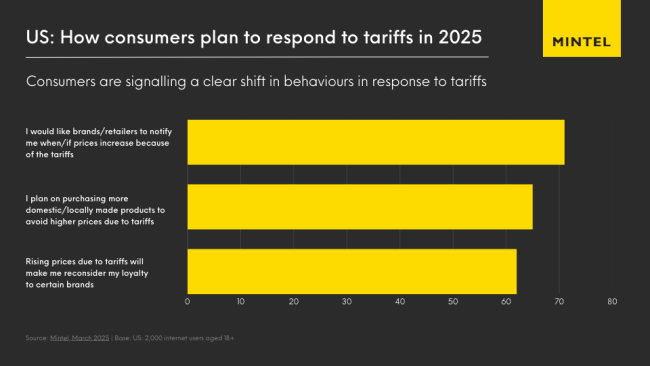

71% of US consumers report that they would like brands/retailers to notify them if/when prices increase because of the tariffs.

“Liberation Day”: What Tariffs Mean for US Consumers (Client-access only)

Many brands raised prices following the pandemic to contend with material costs and supply chain issues, often leaving consumers to notice the increases at checkout. To adapt, brands need to be proactive and bring consumers along on the journey as they make adjustments to their business models to contend with this new economic shift, as consumers are more discerning and informed than ever. A lack of transparency will erode trust with consumers…and eventually impact sales and market share.

Brands also need to prepare for the expectation of increased transparency in other facets of their business. In today’s era of information sharing and social media, operational practices have the potential to be exposed at any time. Recent posts from China, for example, have revealed manufacturing practices of luxury and beauty brands, showing how quickly scrutiny can arise. Brands must be prepared to future-proof their operations and remain agile, ready to pivot quickly if a practice or protocol comes under scrutiny, ultimately protecting both their business and reputation for the long term.

Inaction is riskier than investment and innovation

During periods of uncertainty and changes in major global events, we’ve seen businesses and brands react in the same way as consumers, with a focus on reducing spending, especially around innovation. Over the past 30 years, our Global New Products Database has shown a notable slowdown in innovation activity from brands during these challenging periods.

Harvard Business Review reported that brands that continued to invest in advertising during the 1980s downturn experienced longer-term growth than those that pulled all marketing efforts.

Harvward Business Review

Now more than ever, advertising creative and value propositions should consider and reflect anticipated behavior changes of consumers, and the emotional impact on external factors and market shifts.

That’s where our Mintel Consulting team comes in. We’re here to help you and work with you to avoid the risk of inaction, provide fresh perspectives, and create winning strategies tailored to your individual objectives.

Whether you need short-term solutions to highlight must-have product features or want to future-proof your innovation pipeline, our predictive modeling can guide you. We’ll help identify ways to stand out today while uncovering future growth opportunities in your category.

Let’s take on this new era together. Reach out to the Mintel Consulting team today, and we’ll help you create a tailored strategy that sets your brand up for long-term success.

Contact a Consultant