While 2022 challenged consumers during the festive period with concerns and anxieties around increasing prices and global instabilities, festivities in 2023 saw improved confidence, translating to an uptick in spending among higher earners, and greater gift spending in higher-ticket categories like jewellery and watches. This isn’t to say that amid ongoing inflation, consumers weren’t still forced to review their spending.

In 2024, consumer confidence ahead of the holidays has been mixed. Many are still weakened from the cost of living crisis and shoppers have continued to be cautious, and plan to make use of promotions and discounts during the 2024 holiday retail season – similar to 2023.

Read on to explore the seasonal shopping behaviour of consumers across Mintel’s key markets — UK, US, and Germany — and what Christmas shopping trends retailers can expect in 2024.

Financial Worries Continue to Impact Gifting Trends

Despite an expected financial recovery, continued overall consumer cautiousness across markets results in strategic purchasing behaviours, and value and cost-conscious preferences when participating in holiday retail sales this year.

Black Friday plays a crucial role in Christmas sales

Black Friday promotions are an important element in the gifting industry and were crucial in encouraging the activation of demand in 2023, as the majority of consumers used Black Friday discounts to buy Christmas presents.

With more demand in the market year after year, it is important that retailers are strategic in when, and the level in which they promote. The trend of purchasing gifts earlier reversed in 2023, with the number of consumers buying before October falling from 26% to 21%. This reversal shows the disruptive power of Black Friday (happening annually in late November) and promotions in December, with many clearly now trained to wait for this period before purchasing.

To gain more detailed insight into the workings of Black Friday and how to incorporate it into your marketing strategy in future, read our Black Friday Trends, Takeaways and Inspiration for Retailers in 2024 article.

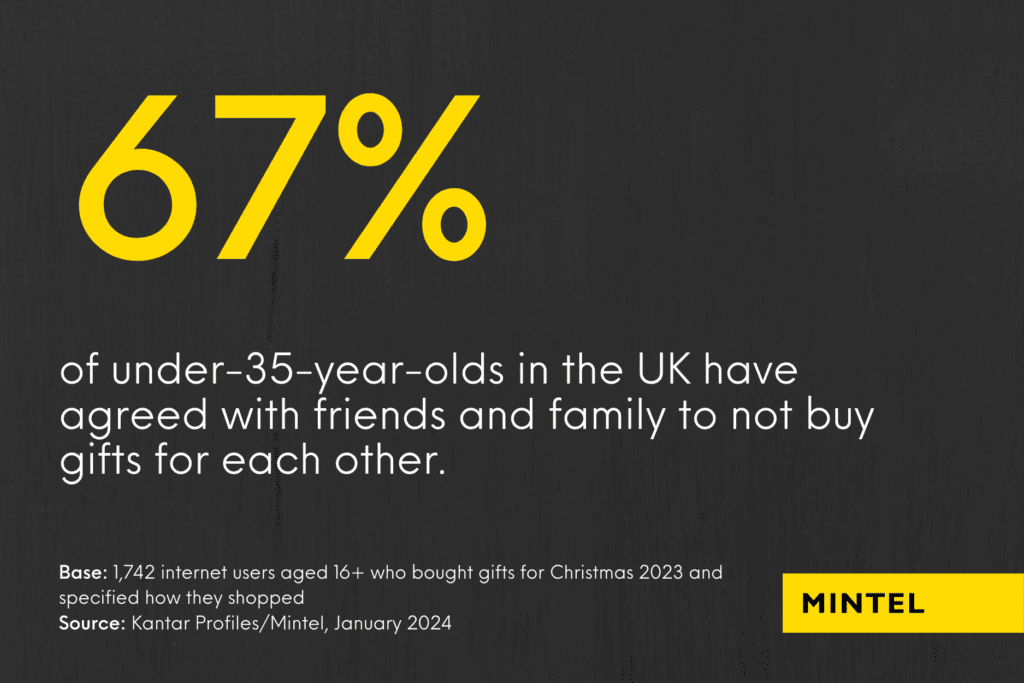

Gift reduction helps buyers save on costs during the festive period

Reducing the number of gift recipients is a practical way to keep costs down. Gift reduction, a seasonal trend driven by financial and ethical concerns, was gaining traction pre-pandemic. While this trend was temporarily paused during the peak of the pandemic, as retail benefitted from less opposition to spending, it has returned strongly in a market where value is top of the agenda.

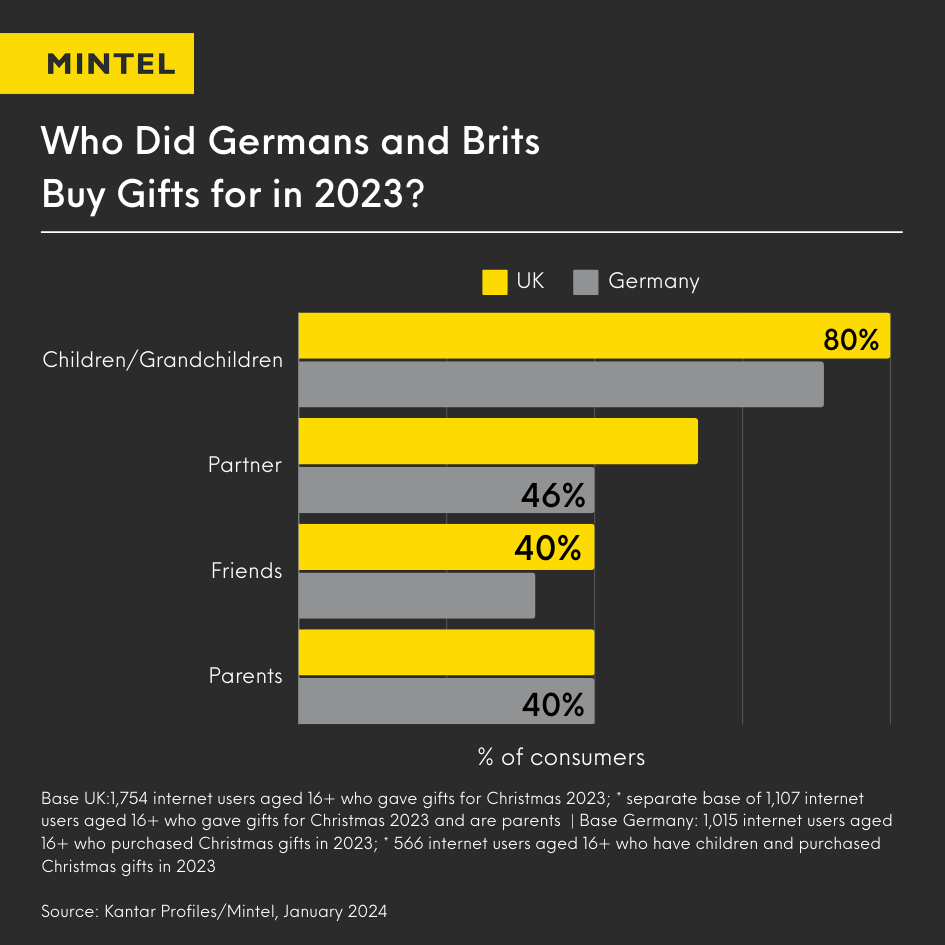

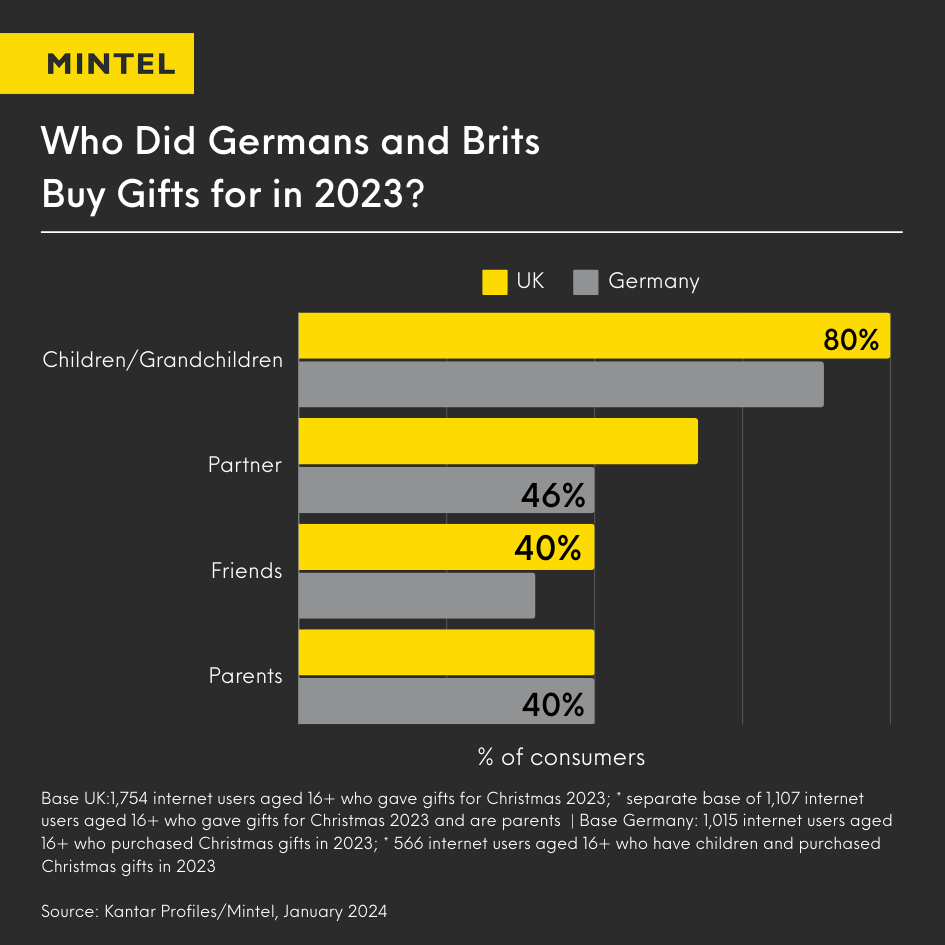

Who are people buying Christmas gifts for?

While value is the primary driver, concerns around over-consumption and the impact on the environment from throwaway gifting are also on buyers’ minds. However, this gift reduction trend is a natural threat to festive demand. For brands and retailers, it is important to challenge this directly with low-ticket, value-for-money gifting options which serve to reassure consumers’ ethical and environmental concerns.

Secret Santas and gift exchanges are emerging as gifting trends

Almost a third of gift buyers participated in a Secret Santa in 2023.

UK Christmas Gift Buying

The number of people participating in schemes like Secret Santa designed to keep costs down grew from 26% in 2022 to almost one-third of Brits. It may come as a surprise that participation in such schemes is greater among higher-earning households, potentially owing to a higher instance of office-based working among this group. However such schemes are becoming more common within family units, particularly for extended family gifting.

With the popularity of Secret Santa-style gift exchange schemes rising among current Christmas shopping trends, it is critical retailers appeal to shoppers through convenience. As more consumers adopt these schemes with their families, they will increasingly look for gifts that provide a personal touch. Providing tools or technology that enables shoppers to filter products to find a low-ticket, yet personal gift, is crucial.

Support consumers with relaxed payment terms and different payment options during the holiday retail season

While most move into the festive period with the intention to spend cautiously, ultimately many will find it hard to budget or get caught up in the festive spirit. Therefore, ways to spread the cost are critical for many shoppers, and just under a third, rising significantly among younger consumers, plan to spend more on credit this year.

In 2023 19% of Brits said that flexible payment options were extremely important when selecting which retailer to buy gifts from.

UK Christmas Gift Buying

In a value-centric market like 2023, the need for low prices was critical when choosing where to shop for gifts, with additional support via flexible payment options, such as buy-now-pay-later, being more important for those in a worse financial situation. There will still be a need to fulfill this in 2024, but as more consumers transition into a more positive self-assessment of their finances, the ability for these factors online to dictate retail choice will ease.

In Germany, families’ spending willingness can be leveraged with attractive payment options (Black Friday promotions and payment plans) that allow them to split the cost for toys, games, and other categories that appeal to children. Moreover, the amount families spend on Christmas gifts rises with the age of their children, showing there is room to encourage trading up to more premium gift categories if the cost can be spread across monthly payments.

What Do People Buy the Most During the Holidays?

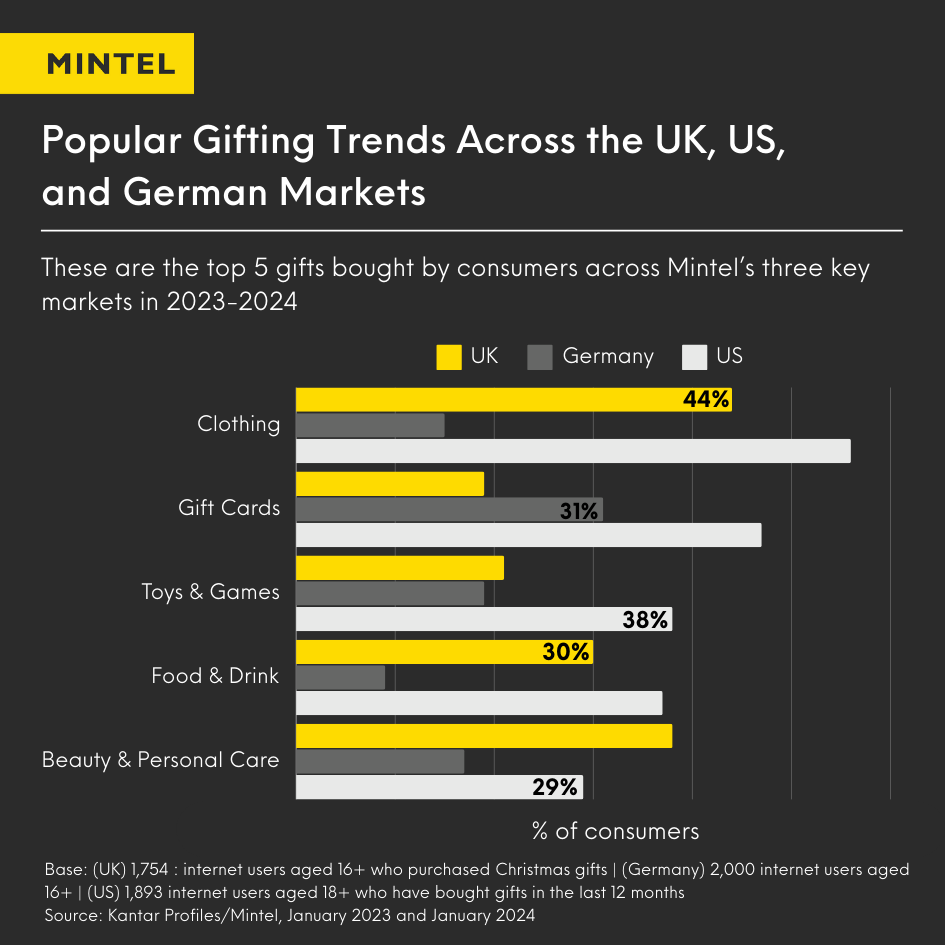

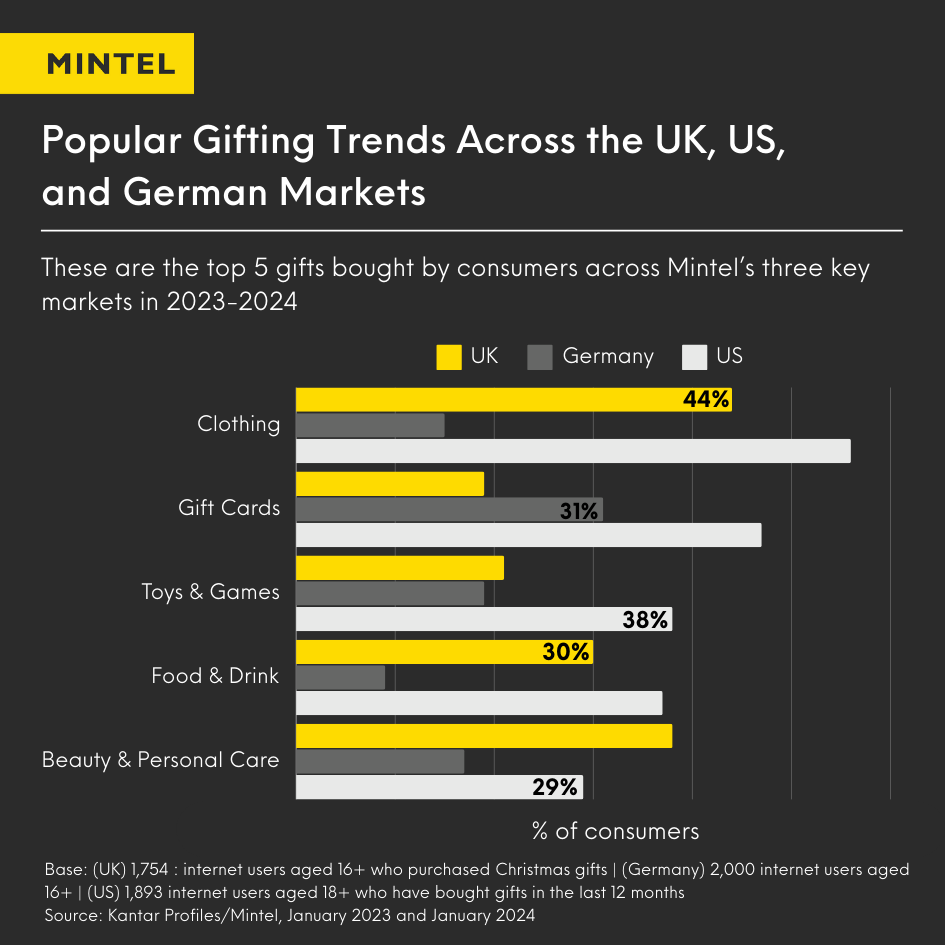

In the UK, only small changes in the leading gifting categories could be observed year-on-year, however, there was a more notable dip in the purchasing of toys and games in 2023. Moreover, higher-ticket categories, such as electricals and jewellery, have seen a notable increase in purchases from higher-income households. This holiday shopping behaviour reflects the seasonal retail trends of gift reductions and gift exchange schemes. The shift towards purchasing fewer but higher-quality gifts — a growing feature of pre-pandemic festive periods — is expected to gain momentum again during the 2024 festive period, as more consumers recover confidence and spending power.

In Germany, gift cards and vouchers are the most popular Christmas gifts. Their popularity ties in with a more sustainable approach and a step away from throwaway culture by enabling giftees to choose what they really need. Besides flexibility, gift cards allow shoppers to stick to a fixed budget. Brands in the gifting industry could therefore explore promoting vouchers as an affordable and sustainable way of gifting.

In the US, buyers continue to rely on “safe” categories as their go-to choices for gifting occasions, such as clothing and footwear as well as gift cards. However, younger gift givers are all about memorable gifts, including handmade presents and subscription services. Meanwhile, older shoppers are more inclined to opt for gift cards, as they perceive them as more practical. Brands and retailers can make gift cards more attractive to younger consumers by promoting them digitally, allowing recipients to add them to shopping apps/accounts and making them more of a “memorable” gift through personalisation components such as messages or visuals.

Holiday retail trends forecast: A look at what might top the Christmas wishlists in 2024

- The next generation of Nintendo ‘Switch 2’ was due to make a splash in autumn 2024, slotting in nicely before this year’s seasonal retail, providing opportunities surrounding both the device and accessories to top many wishlists. However, it is now more likely to launch in the new year. But there will still be opportunities for alternatives.

The third-best-selling console of all time – the Nintendo Switch. Source: nintendo.com

- As UK consumers recover from previous financial strains, they are left with more time to invest in wellbeing. Currentbody’s LED face masks, designed to reduce the signs of ageing, trended in 2023. A focus on health and wellbeing combined with financial recovery will give more scope for demand in beauty and wellness devices in 2024.

CurrentBody’s LED face mask to reduce visible anti-ageing. Source: currentbody.com

- Customised skincare subscriptions are capturing the attention of Gen Z in Germany – Retailers can target this group of shoppers with beauty products as Christmas gifts by aiming to reflect their interests and lifestyles, such as social causes, customisation, and gender-neutrality. For example, FORMEL, winner of the Douglas Challenge for Beauty and Health Innovations 2022, offers a personalised skincare subscription whereby customers receive medical advice and can adjust their skincare routines depending on their skin needs.

Personalised skincare products by FORMEL. Source: formelskin.de

It’s the most wonderful time of the year: Make at-home occasions special with premium product ranges

The strong performance in the UK grocery sector, particularly around premium product ranges, indicates a market where consumers were willing to trade up for affordable luxuries. With this notable seasonal shopping behaviour in mind, M&S focuses on making in-home celebrations special across its food and clothing adverts.

Premiumisation also creates opportunities for affordable indulgence during the festive season in the German market where grocery retailers have been promoting premium food and drink ranges to make in-home events more special, whilst expanding their premium own-label offering to encourage trading-up. In fact, more consumers are likely to cut back on eating out than on premium food and drink.

How Seasonal Shopping Behaviour Affects Different Retail Channels

Online continues to take the lead in holiday retail sales

Online sales in the UK have been strong throughout 2023 and this pattern continued with particularly strong online demand in November due to Black Friday. The online channel owes much of its success to its positive value perception with a majority of shoppers believing the best prices are found online.

The holiday season retail in Germany is also dominated by the online channel: 80% of Germans have made Black Friday and/or Christmas gift purchases online, compared to 35% who bought in-store. The positive value perception of the online channel endures in Germany as well as in the UK.

Christmas gift buyers in the US get ideas across different channels, but the digital influence is clear among younger audiences. The inherent role influencer marketing and social media have in their lives drives product discovery and inspiration Overall, Amazon is the most-shopped retailer for online shoppers and almost 70% start their shopping journeys with the brand. The diversity in assortment, convenience and competitive pricing are the trifecta that benefits the retailer.

In-store is still crucial in providing a festive spirit during the holiday retail season

Although the majority of holiday retail sales have shifted online, brick-and-mortar stores still hold strong appeal, partly because they help get shoppers in a festive mood.

Social media, as well as AI, are key tools for buyers for ideation, inspiration, and research. However, digital channels have not fully replaced the influence of the physical store. As the use of AI continues to grow, reinforcing the importance of stores and human interaction from multi-channel retailers will be key to insulating more demand in physical locations.

Holiday shopping trends show that a multi-channel approach is the way forward

At 55%, the majority of consumers in the UK take a multi-channel approach to their Christmas gift buying, as they make use of online price tracking and comparison tools, but ultimately purchase in-store.

Especially, those with larger repertoires of recipients to buy gifts for, such as parents, are naturally more likely to be multi-channel gift buyers, utilising both channels to fit gift buying into busy schedules.

Looking At Future Holiday Retail Trends With Mintel

For the best value perceptions, consumers across markets wait for Black Friday promotions to shop for Christmas gifts, and primarily do so online to get the best deal. But Christmas retail trends show that despite the digital channel’s grasp on retail power, brick-and-mortar stores remain an essential part of the festive shopping experience, as they spread Christmas cheer. Brands and retailers offering a multi-channel experience will likely appeal the most to shoppers, as they get inspiration online to then make their purchases in-store.

If you’re interested in receiving more market insights and fresh perspectives from our analysts wrapped up for you and delivered directly to your inbox, subscribe to our free newsletter Spotlight or contact us directly for tailored-to-you insights.

Subscribe to Spotlight

Get in touch