Key Takeaways

Is capital rotating from Gold back into Bitcoin?

Current price action suggests a shift toward risk-on assets, with investors reducing defensive exposure in Gold while reallocating into Bitcoin.

What determines whether Bitcoin’s rebound continues?

A clean break and sustained close above $115,000 is critical. Without it, the rally may stall, and consolidation could return.

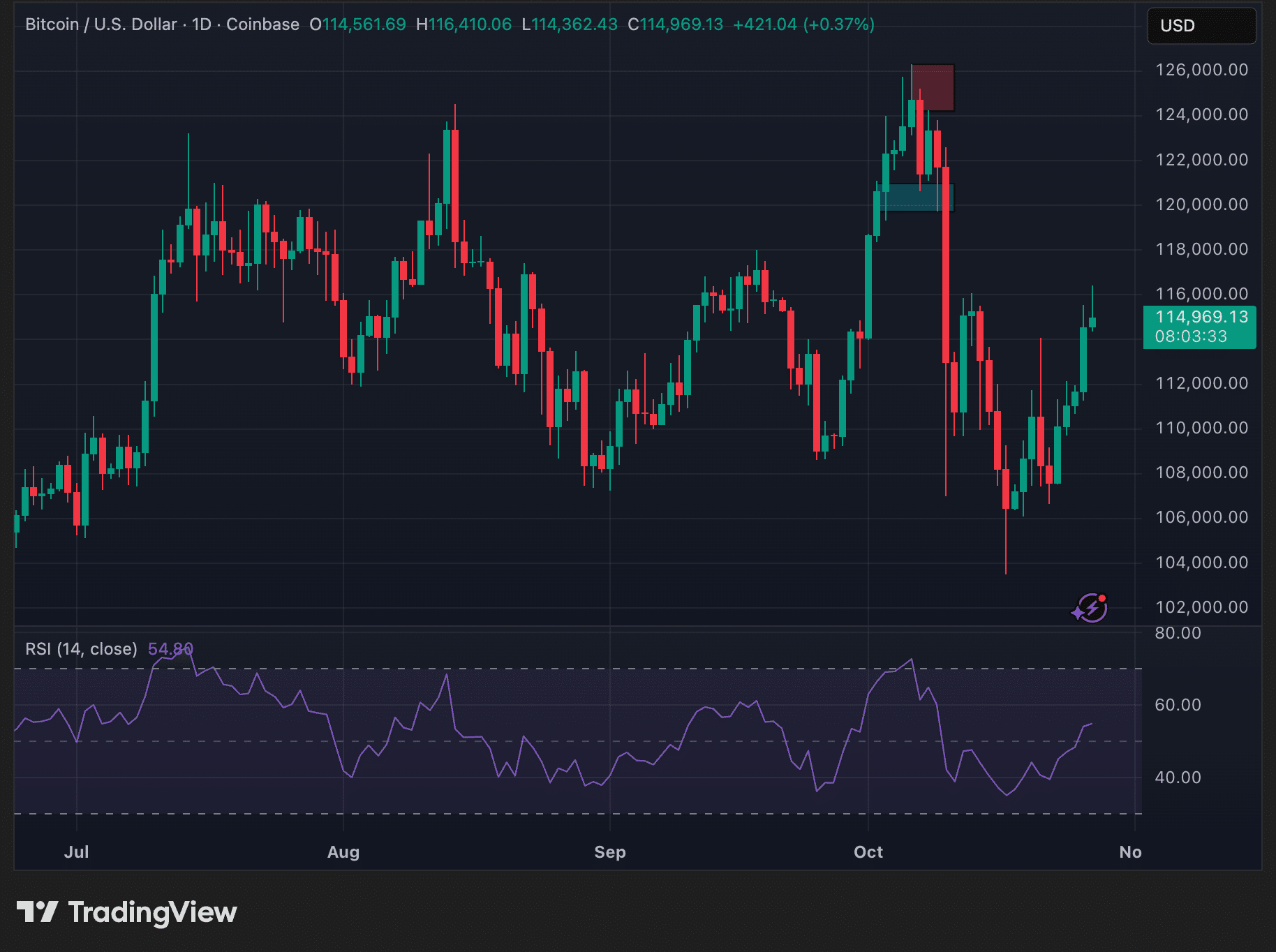

Bitcoin has regained the $115,000 level after posting five consecutive days of gains, while Gold has fallen sharply from its recent record high.

The opposing trends suggest that some investors may now be rotating out of defensive safe-haven positions and back into higher-risk assets as market sentiment improves.

At the time of writing, Bitcoin trades around $115,071, recovering from its mid-October drawdown and reclaiming a key psychological level.

The recent bounce pushed Bitcoin’s daily RSI back toward neutral-bullish territory near 55, indicating strengthening momentum after a period of consolidation.

Source: TradingView

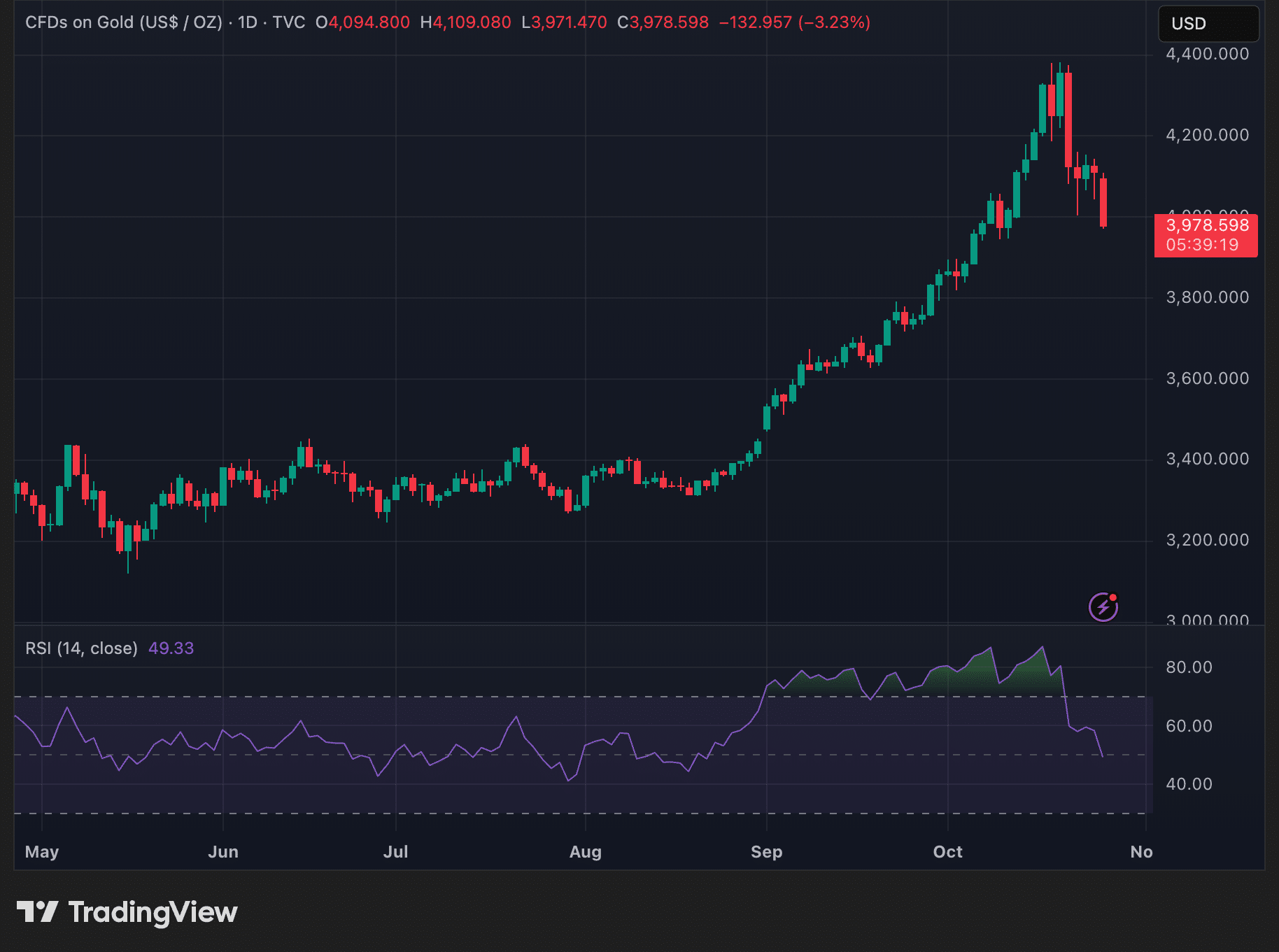

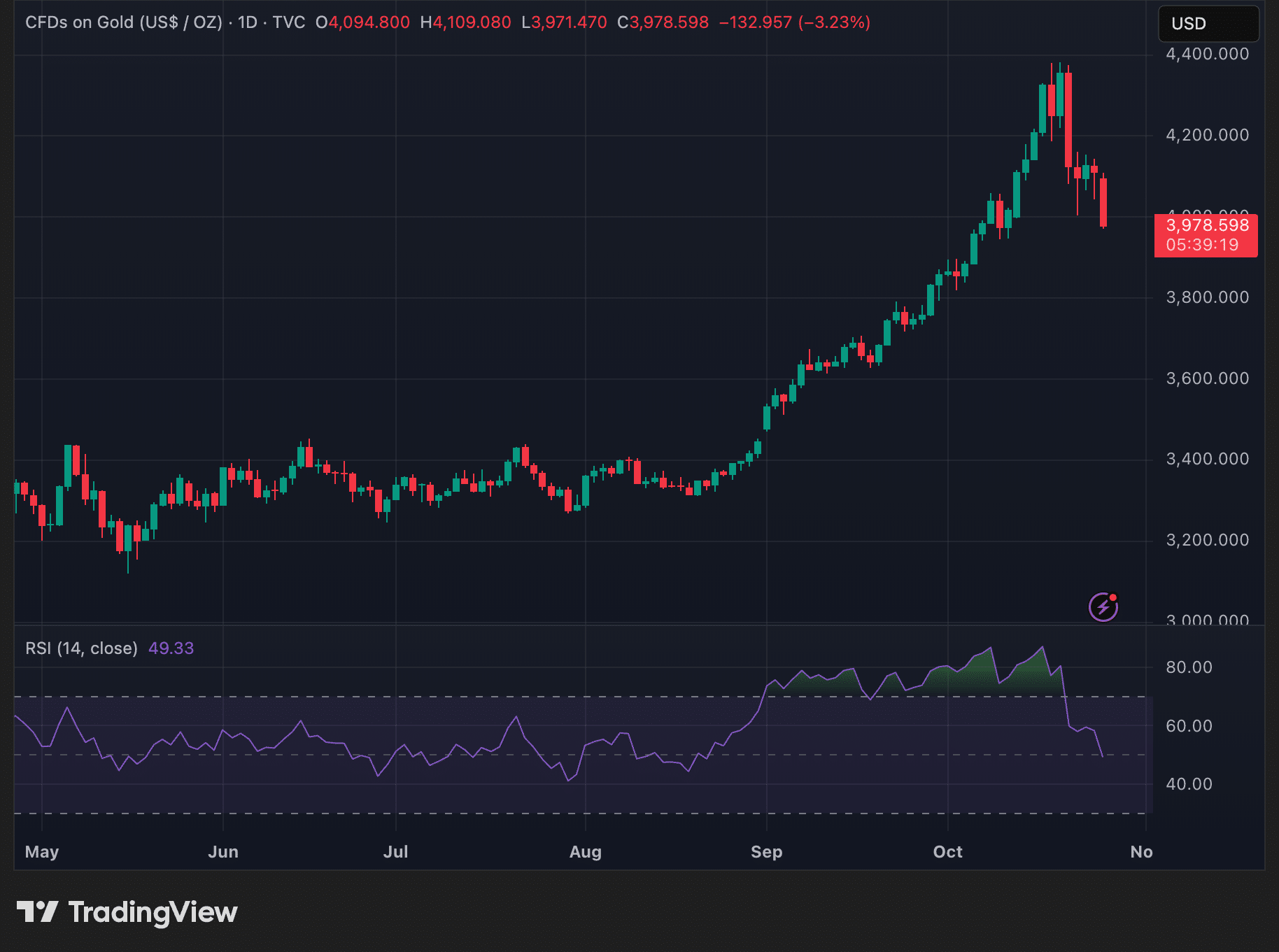

Gold, meanwhile, has reversed sharply from its all-time high of $4,381 recorded last week. The metal now trades near $3,980, down more than 9% from its peak.

Source: TradingView

The pullback has dragged its daily RSI beneath 50, a signal of fading buying pressure and weakening bullish momentum.

Risk appetite returns — for now

The price divergence between the two assets reflects a shift in investor positioning following months of macro-driven caution.

Gold’s surge to record levels in early October aligned with increased demand for hedges amid geopolitical tensions and uncertainty around global rate policy.

During the same period, Bitcoin experienced outflows from speculative long positions and a shift towards stable, low-volatility assets.

That dynamic now appears to be easing.

Bitcoin’s rebound suggests renewed willingness to take on risk exposure, particularly as ETF inflows stabilize and volatility compresses across crypto derivatives markets.

Meanwhile, Gold’s retreat signals an unwind of short-term hedges and safe-haven accumulation.

However, the rotation remains early and incomplete. Bitcoin still faces familiar resistance between $115,000 and $118,000, an area where futures traders have historically applied hedges and taken profit.

A decisive daily close above that zone would be required to confirm trend continuation.

What the charts suggest

- Bitcoin (BTC): Higher lows form a short-term recovery structure, with volume rising during green candles — a constructive sign.

- Gold (XAU): The breakdown from its peak lacks strong volume follow-through, indicating a potential stabilization attempt near the $3,900–$3,950 support band.

If Bitcoin holds above $112,000 in the near term, momentum may remain favorable. Conversely, a close below that level could reopen downside toward $108K.

What comes next

The key variable from here is ETF and institutional flow behavior. A sustained pickup in spot demand would validate the rotation narrative. Conversely, if macro uncertainty accelerates, capital may return to Gold quickly.

For now, the market appears to be in a measured risk-on reset, not a complete sentiment shift. Traders are testing risk exposure — cautiously.

The next decisive move will determine whether this becomes a structural rotation or a temporary positioning adjustment.