Key Takeaways

Why is the stablecoin supply soaring to record highs?

Tether and Circle have minted over $11.75 billion in new stablecoins, pushing total supply to $305.2 billion.

Why are stablecoins important for crypto’s growth?

They drive on-chain demand, liquidity, and global money movement.

Stablecoins are having their biggest moment yet!

The total supply has soared to a record $305.2 billion, with fresh mints from Tether [USDT] and Circle [USDC]. Both have minted over $11.75 billion in the past month, including $1 billion USDT this week alone.

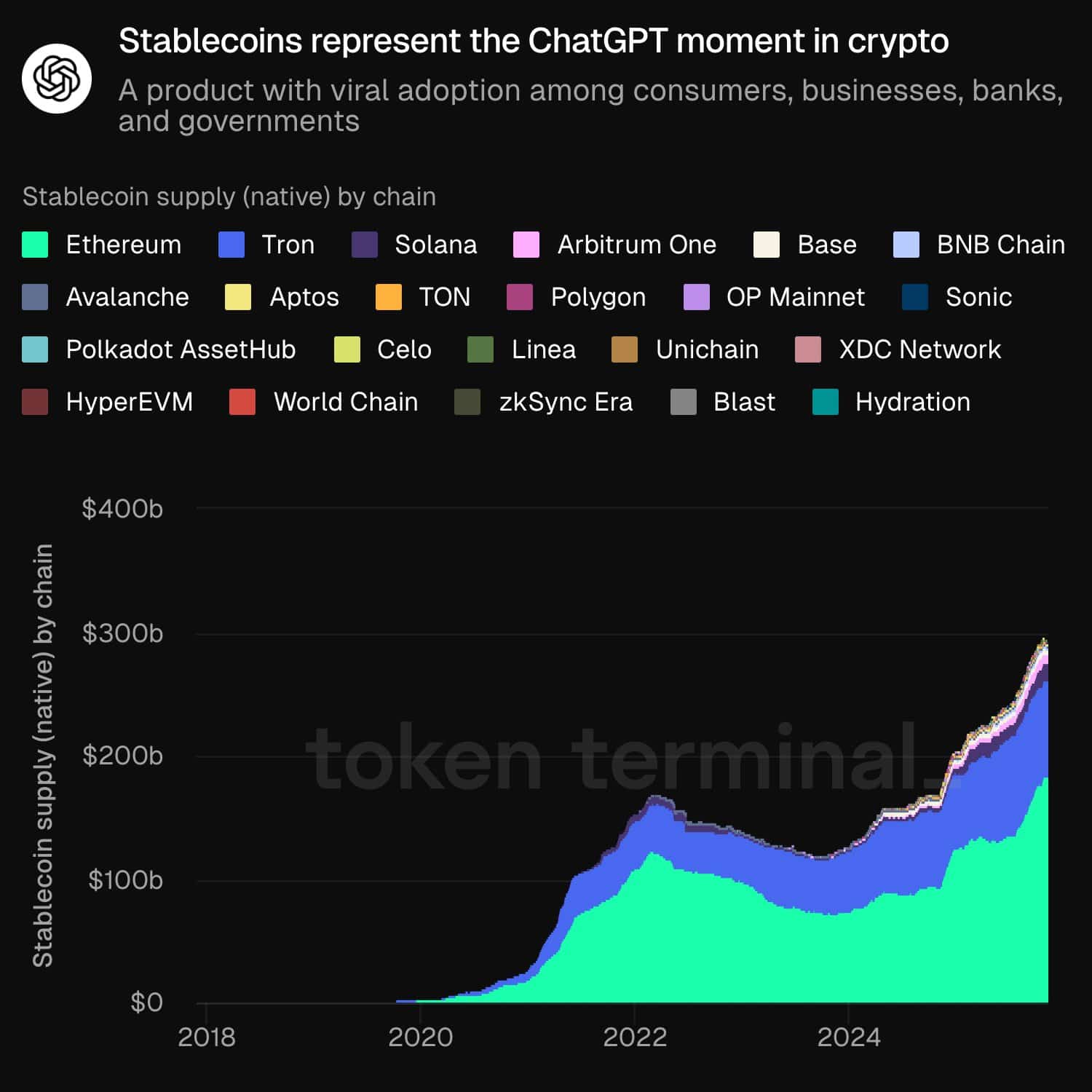

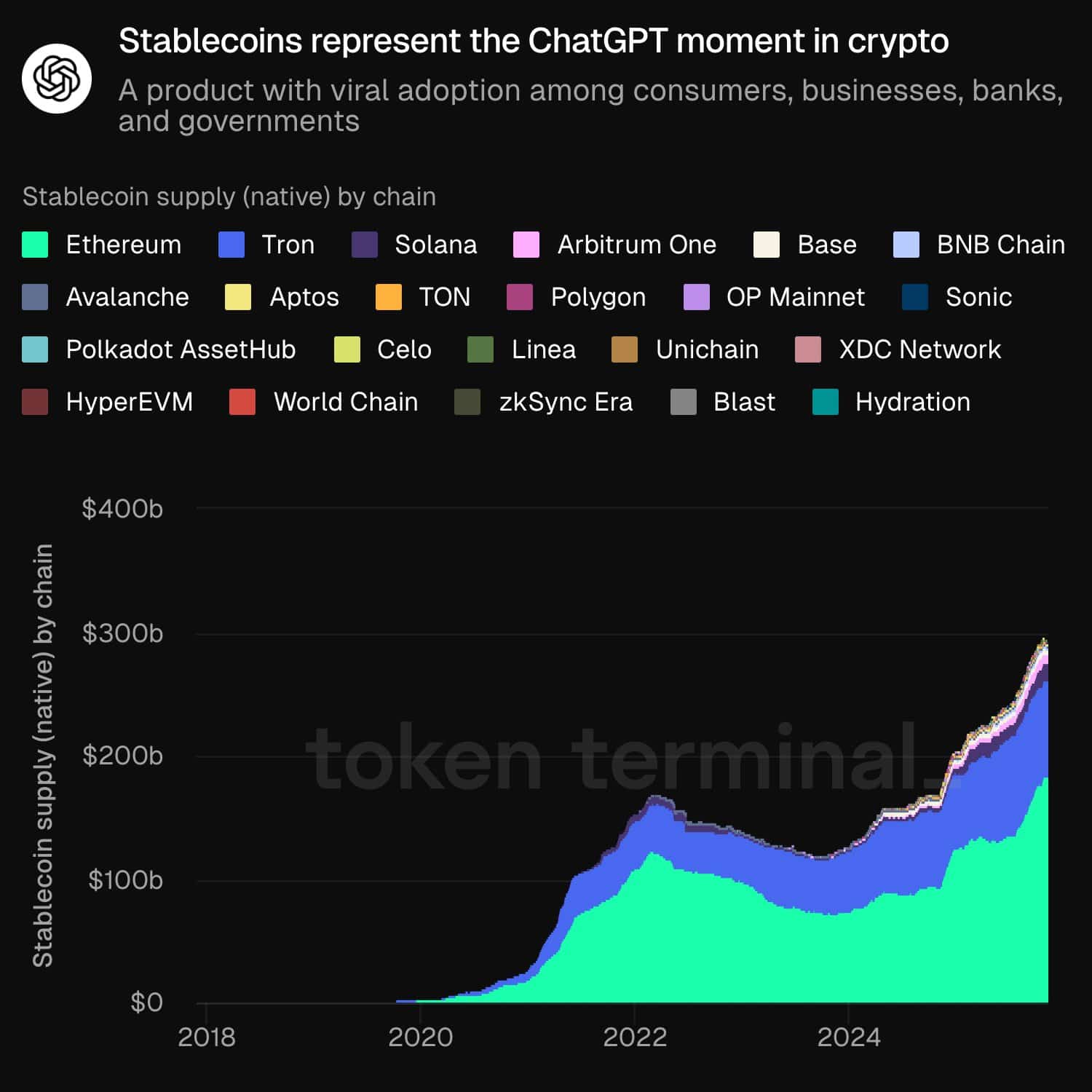

Stablecoins have slowly become crypto’s first truly viral product, creating demand and activity across the board.

Stablecoin supply surges as mints accelerate

Stablecoins are setting new records almost weekly.

Source: Artemis

The total supply has crossed $305.2 billion, according to data from Artemis. This is a 1,352% rise since 2021.

Source: X

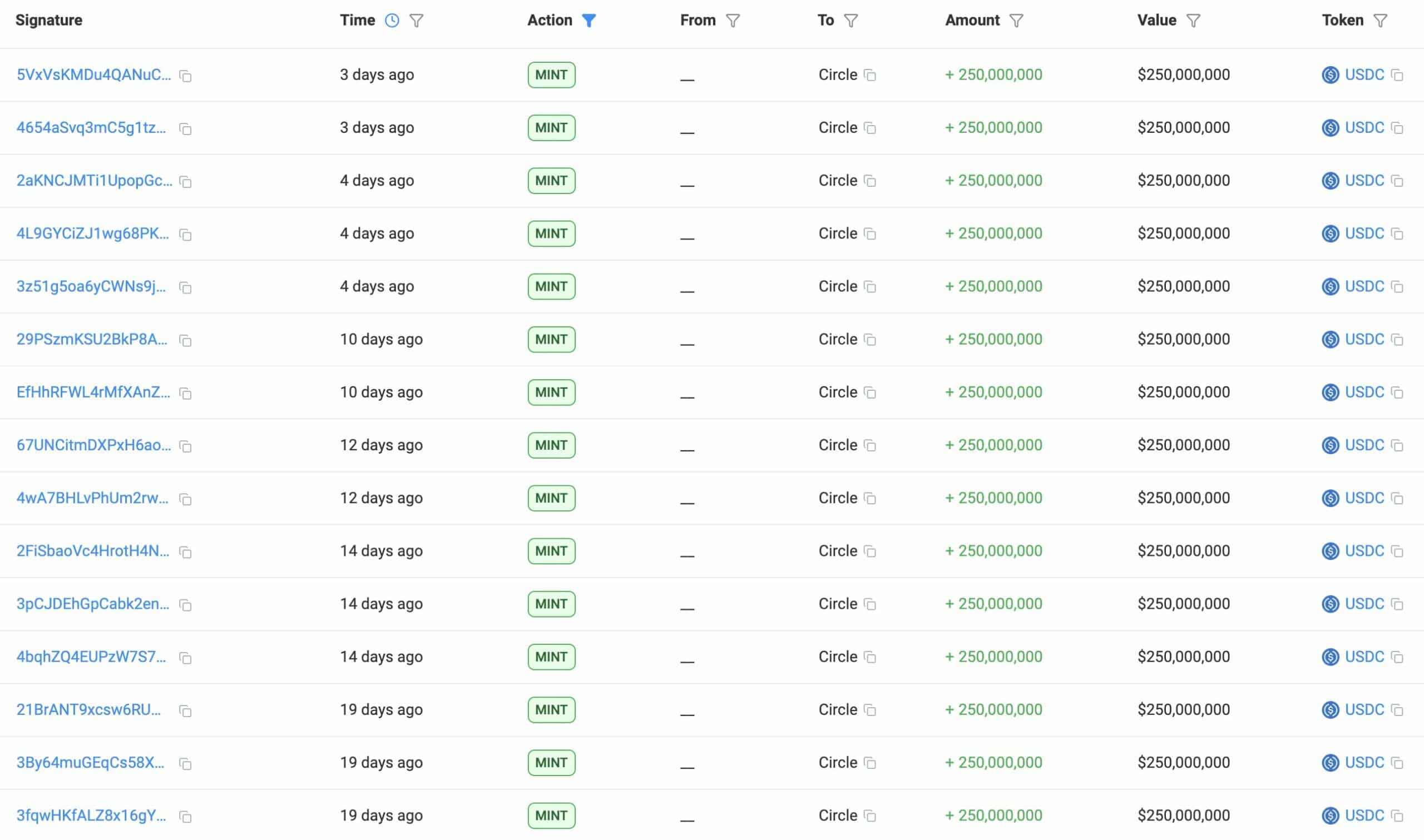

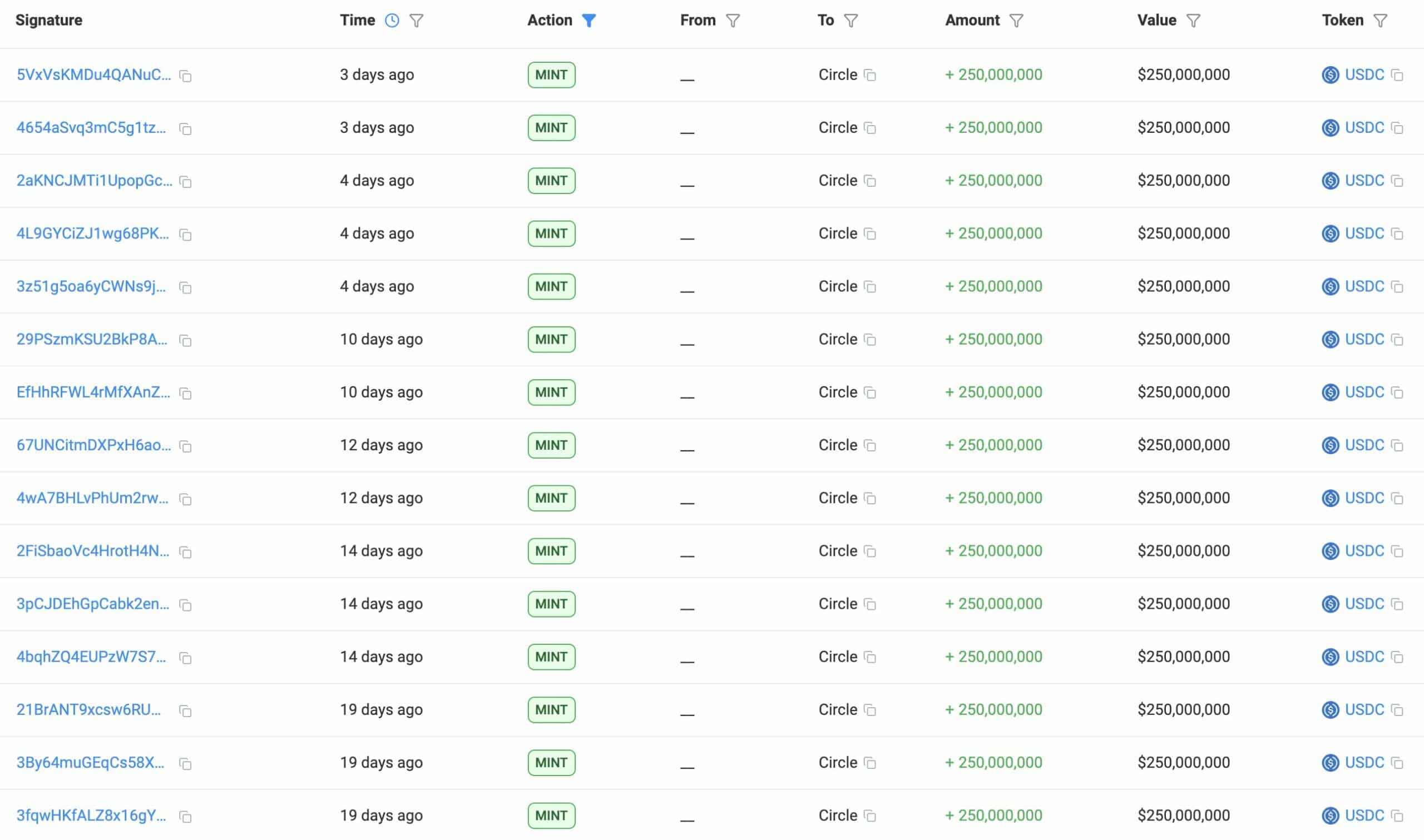

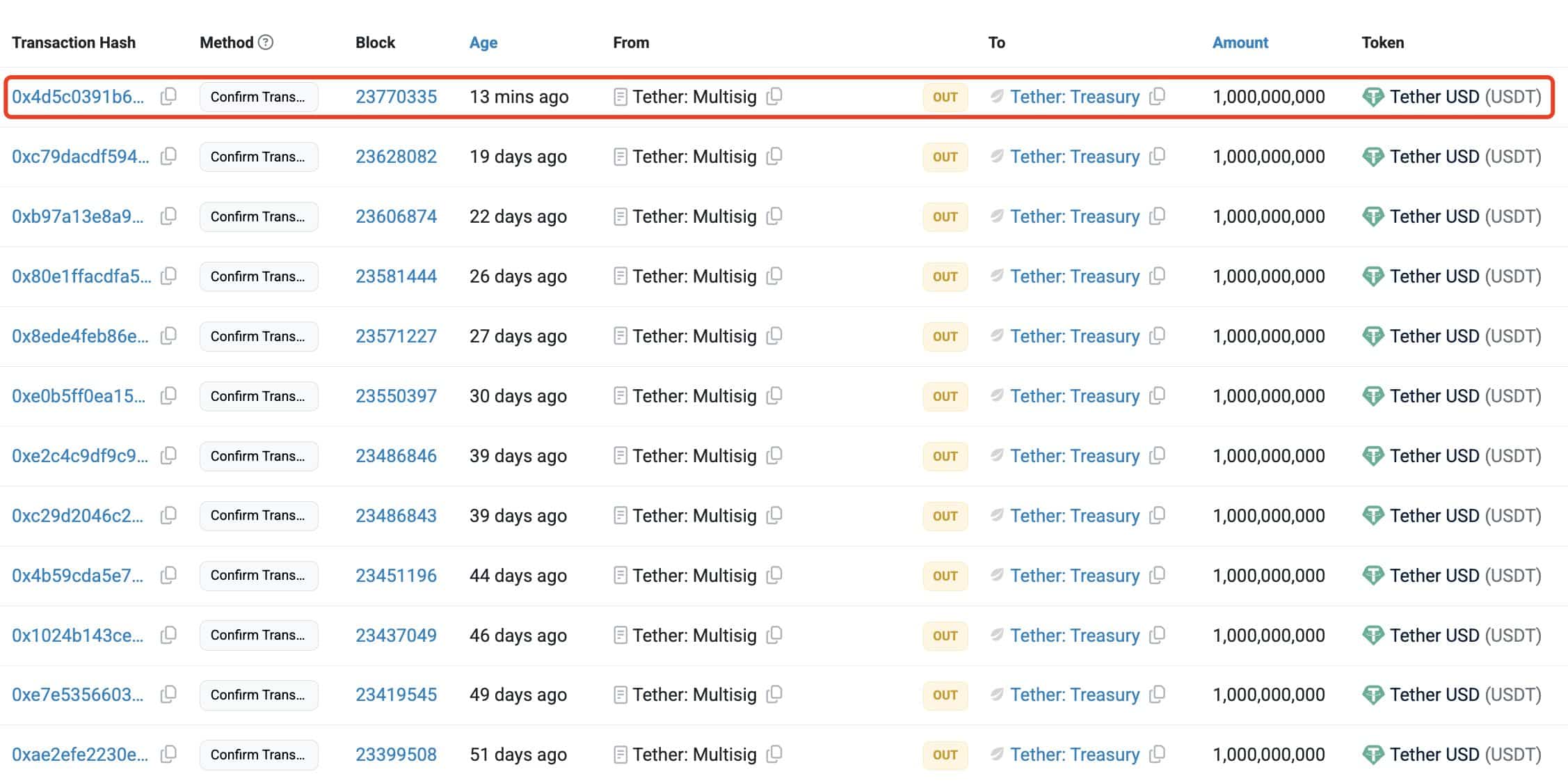

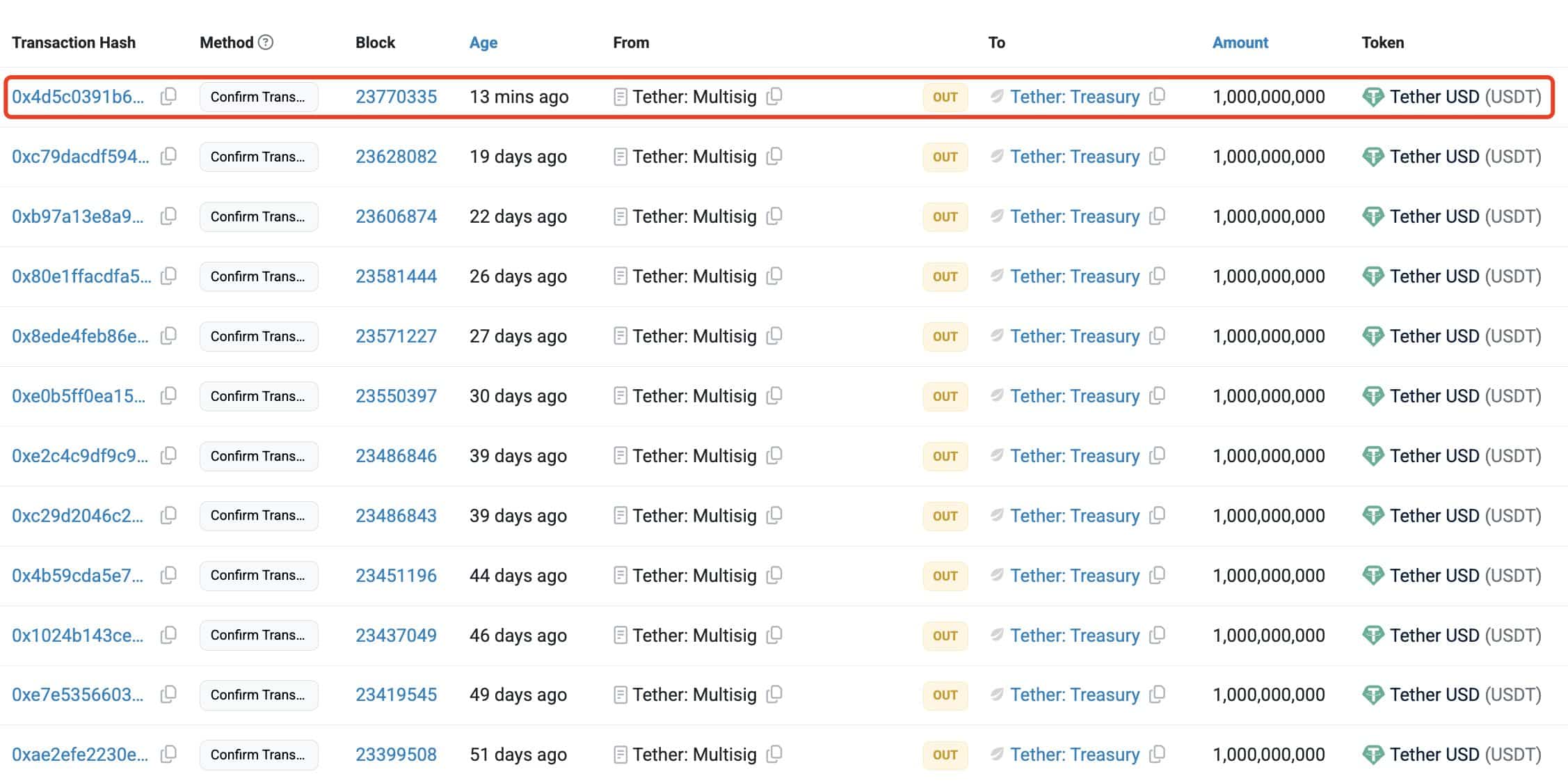

According to Lookonchain, Tether and Circle have minted $11.75 billion worth of USDT and USDC in the past month alone! $1 billion USDT was printed only this week.

Source: X

There is strong on-chain demand and liquidity across crypto markets, and these are hardly the conditions of a bearish phase.

Stablecoins are tokenization’s strong proof of concept

Stablecoins have emerged as crypto’s first product with mass-market appeal. They are used daily by consumers, businesses, banks, and even governments.

Every transaction drives demand for blockspace, turning stablecoins into the backbone of on-chain activity. The supply spans multiple chains from Ethereum [ETH] and Tron [TRX] to Solana [SOL] and Base [BASE].

Source: X

As BlackRock’s Head of Digital Assets, Robbie Mitchnick, put it,

“The bear case for tokenization is that only stablecoins work. But it’s hard to imagine a world where not even stablecoins have significant adoption.”

He called the $300 billion market cap in a high-interest-rate setting “remarkable,” proof of persistent global demand for digital USD that moves “in near-real time at near-zero cost.”

If stablecoins are the bear case for tokenization, then it’s a remarkably strong one. We’re watching in real-time what mass adoption of on-chain finance looks like in practice.